Investment Banking & Financial Modelling Course with Certificate

Want to kick start your career in Investment Banking? A premium training program to help you master the Investment Banking domain.

0

days0

hours0

minutes0

secondsCOHORT

STARTS

CA Saksham Agarwal

Stock Market Expert

Founder of Jobaaj Group

Rahul Sachdeva

Investment Banking and M&A Consulting

Investment Banker at PWC

Sai Sashanka Paladugu

Investment Banking | M&A Expert | Finance Leader

Vice President at Leading Global Bank

Ankur Goel

Investment Banking | Equity Research Expert

Associate at leading global investment banking firm

Upskill With banking course and secure a 6-12 LPA investment banking job. 🚀

Practical Learning

Industrial Experience

Capstone Projects

1:1 Mentorship

12+ AI Tools Covered

Where Ambition Meets Opportunity

Welcome to the Jobaaj Ecosystem

Jobaaj Group is a multi-domain ecosystem with its own job portal and edtech platform. It aims to empower individuals through career opportunities, industry-relevant courses, and professional development resources.

The group offers services like interview preparation, resume building, LinkedIn optimization, and AI-powered career tools. These solutions help job seekers and professionals boost their visibility and land better career opportunities.

Jobaaj also promotes innovation and well-being through its physical spaces like the Jobaaj Work Café and Jobaaj Fit, creating a balanced environment for work, collaboration, and fitness.

Success Stories 🏆

Experience the compelling playlist featuring Jobaaj's students' incredible success stories. Explore how Gauri conquered career hurdles and secured her dream job at Preqin, and witness Simran's entrepreneurial victory, launching a thriving business with Jobaaj's guidance. From Savita re-entering the workforce with upgraded skills to Dasari getting a 12+ LPA job as a fresher, this collection celebrates Jobaaj's empowering impact on lives

Video Playlist

Setback to Success: Journey from ACCA to Valuation Analyst with Jobaaj

13 Min 13 Sec

CFA Admin executive to Core Valuations role with Jobaaj's help

14 Min 23 Sec

Science Lab to Finance Desk: Tarun’s Career Transition with Jobaaj Learnings

26 Min 55 Sec

Rishab Yadav's Success Story: From Student to Consultant at a Leading Fintech Company

5 Min 52 Sec

How Shruti Moved from Finance to a Digital Marketing Job

5 Min 51 Sec

From Finance Student to Consultant: Uma’s Dream Job Journey

10 Min 50 Sec

From Engineering to Consulting: Prasanjit Rout’s Unconventional Path with Jobaaj

6 Min 34 Sec

MBA Finalist landing a job in Finance on 1st attempt with Jobaaj Learnings

13 Min 26 Sec

Graduate Fresher to Core Finance with Jobaaj's help!

9 Min 48 Sec

Jobin Bags 36 LPA Job in Maldives with the help of Jobaaj

13 Min 45 Sec

How an MBA Fresher cracked Citco with Jobaaj's help!

11 Min 35 Sec

From BCom to Big Break in Finance – Balaji’s Journey with Jobaaj Learnings

26 Min 24 Sec

5+ yrs as Teacher to Financial Analyst: Sweety's Success with Jobaaj Learnings

13 Min 20 Sec

From a Business Psychologist to a Management Consultant, how Sakthi got placed II Jobaaj Learnings

8 Min 58 Sec

Hear from Ansh about his Digital Marketing Journey II Jobaaj Learnings

21 Min 47 Sec

From being a Mechanical Engineer to a Program Manager, how Jobaaj helped Ameen achieve this

7 Min 7 Sec

From a UX Designer to a Product Manager, how Jobaaj Learnings helped Ayushi transition.

11 Min 29 Sec

Sufiyan Ahmad - BBA to Data Analyst at Invergence Analytics

10 Min 55 Sec

How our Management Consulting Programme Helped Aravinth Get Hired at Dostbin Solutions

14 Min 20 Sec

From B.Com Graduate to Aspiring Consultant, Arpit's Journey with Jobaaj Learnings

11 Min 32 Sec

From BA Graduate to Digital Marketing Intern with the help of Jobaaj Learnings

8 Min 36 Sec

From B.Com to Data Analytics Pro: Ravi’s Success Story with the help of Jobaaj Learnings

5 Min 39 Sec

How Priya cracked a 10+ LPA package with Jobaaj's help

13 Min 47 Sec

From a Fresher to a Management Consultant at Uphead with the help of Jobaaj Learnings

10 Min 35 Sec

From IT Engineer to Data Analyst at EY | Pramod's Journey with Jobaaj Learnings

7 Min 22 Sec

How a 21yo B.com Fresher secured a Finance Role

19 Min 23 Sec

How Jobaaj’s Digital Marketing Program Landed Somya a Job at Future MBBS Gurgaon!

7 Min 57 Sec

Tier 2 MBA to core WFH Finance Role with Jobaaj's help

23 Min 6 Sec

From Project Coordinator to Data Analyst at Zeta Global II How Jobaaj helped Khushi

14 Min 41 Sec

Hear from CA turned in to Product Manager || Placed at 15 LPA in DelTeck

11 Min 13 Sec

From Banker to Management Consultant, how Jobaaj helped Harsh Transition

8 Min 50 Sec

Cracking 12+ LPA Job in Deloitte: How Atishay got placed with Jobaaj's help

15 Min 49 Sec

How Sanskriti Landed Her Dream Investment Banking Job with Jobaaj Learnings!

9 Min 47 Sec

From Commerce Student to Data Analyst: How Jobaaj Helped Secure a Role at FedEx!

8 Min 29 Sec

From B.tech Student to Accenture: Madhulitha's Success Story II Jobaaj Learnings

5 Min 28 Sec

From Amazon to FedEx, how Jobaaj helped Chandan

6 Min 42 Sec

From Sales to Finance: Khushal's transition with Jobaaj Learnings

5 Min 11 Sec

How a CA Finalist secured a 6+ LPA role in Finance with Jobaaj's help

17 Min 30 Sec

MBA fresher to Core Finance Job: How Jobaaj made it happen

15 Min 43 Sec

How Jobaaj Helped Rishi Get Placed as an Analyst in Gurgaon

4 Min 38 Sec

From Relationship Manager to Real Estate Analyst: Vikram's Success Story at Jobaaj

27 Min 8 Sec

How Jobaaj Student Saheba Cleared 8 Rounds to Become a Data Analyst | From Sales to Tech Success

8 Min 21 Sec

Science to Stocks: Jobaaj’s Role in a Career shift to Finance

9 Min 35 Sec

Cracking 12+ LPA: Jobaaj’s Guidance for a Student’s High-Paying Finance Role

13 Min 28 Sec

Kavya - Marketing Analyst for Deloitte Australia

8 Min 43 Sec

Hear from Shivam about our Data Analyst Program II Jobaaj Learnings

7 Min 23 Sec

Hear from Akshay about our Data Analyst Programme || Jobaaj Learnings

12 Min 37 Sec

How Jobaaj helped Bhavna secure a job as Lead Generation Specialist || Jobaaj Placement Services.

8 Min 40 Sec

Hear from Deep how he learnt to forecast the future of Companies || Jobaaj Learnings

4 Min 56 Sec

Hear from CA Shubham, how Jobaaj can help you get multiple Job Opportunities!

17 Min 6 Sec

Hear from Riyaz how he transitioned from to Product Management || Jobaaj Learnings

10 Min 29 Sec

Hear from our Student how he bridged his Career Gap || Data Analytics || Jobaaj Learnings

8 Min 9 Sec

How Jobaaj help a CA to find their dream Job || Hear the complete story

24 Min 57 Sec

How Danesh got a seven-figure WFH job in Finance || Jobaaj Learnings

17 Min 43 Sec

Hear from Yash how he fought hardship and secured an Internship at Procapitas

24 Min 46 Sec

Hear from Hafsa about how she transitioned in Data Analytics Domain || Jobaaj Learnings

8 Min 1 Sec

Hear from Anchal, how she secured a role as an Audit Assistant

31 Min 51 Sec

Hear from our student who recently got placed as a Financial Analyst || Jobaaj Learnings

7 Min 58 Sec

Hear from our student who recently got placed at 13 LPA package in HSBC || Jobaaj Learnings

11 Min 2 Sec

Hear from Govind about his experience with Jobaaj Learnings || Equity Research Student

10 Min 29 Sec

Hear from Divyanshi about her experience with Jobaaj Learnings || Data Analyst Student

11 Min 39 Sec

Review of our Student from the Data Analytics Course | Jobaaj Learnings Student Review

9 Min 31 Sec

How Jobaaj Learnings helped a PHD Teacher to become Data Analyst

10 Min 12 Sec

Helping people to get placed in Digital Marketing | Jobaaj Learnings

10 Min 23 Sec

From Sales & Customer Support domain to get placed in Data Analytics domain | Jobaaj Learnings

8 Min 2 Sec

MBA from Tier 3 city to getting placed as an Investment Banker | Jobaaj Learnings Student Review

17 Min 25 Sec

Know how Jobaaj Learnings helped Shubham to become Financial Analyst

13 Min 15 Sec

Can you become Management Consultant after doing Engineering?

14 Min 11 Sec

How Jobaaj Learnings help you after Graduation for Placement?

10 Min 8 Sec

Abhinav Kumar got Placed at Business Intelligence Job after Jobaaj Learnings Program

6 Min 33 Sec

Hear from the Student of Jobaaj Learnings who got placed as Data Analyst after Bsc & Msc

7 Min 29 Sec

Are you looking to get into Project Management role?

9 Min 54 Sec

How Himanshu got placed as a stock market analyst | Find out his complete jounrey

9 Min 8 Sec

Vinay Kumar - Bcom - Career Gap - Data Analyst | Jobaaj Learnings Review

7 Min 7 Sec

You can't afford MBA from IIM ? Jobaaj got you covered | Jobaaj Management Consulting Review

8 Min 9 Sec

Data Analytics student got placed | Jobaaj Learnings Student Reviews

13 Min 38 Sec

Data Analyst Students ( Must watch ) | Placed in Samsung | Jobaaj Reviews

14 Min 54 Sec

Switch from Backend Investment Banking Role to Management Consulting Domain | Jobaaj Reviews

12 Min 51 Sec

Divyanshi from Jobaaj Learnings Product Management Program got placed as Associate Product Manager

9 Min 41 Sec

Career Gap to Operations Data Analyst - Ishita Roy

8 Min 46 Sec

Sales/Civil background to Analytics Project Manager - Vipin Rao

7 Min 5 Sec

Interview for Management Consulting/Strategy Job | Jobaaj.com Review

13 Min 22 Sec

Placement in Management Consulting Domain | Jobaaj MCP Review

8 Min 16 Sec

Private video

Feedback/Review of Jobaaj Learnings Investment banking Student

11 Min 1 Sec

Ishita Pandey Placed - Business Analyst (College Students Must Watch)

9 Min 4 Sec

Placed as fresher data analyst - eClerx Pune

7 Min 20 Sec

From HR to Performance Marketing | Mentor Interview with Student | Jobaaj Learnings

6 Min 29 Sec

Placed in Capgemini - Associate Data Consultant

14 Min 56 Sec

Electrical to Analytics Project Manager in Bescom || Jobaaj Data Student

8 Min 32 Sec

1:1 Sessions Helped Me | Even an MBA Lacked Such Experience || Jobaaj Management Consulting Student

18 Min 27 Sec

Offer Letter Received | Jobaaj Investment Banking Student

18 Min 40 Sec

Offer Letter Received | Jobaaj Investment Banking Student

14 Min 55 Sec

Offer Letter from an MNC | Jobaaj Investment Banking Student

15 Min 37 Sec

Joining as a Financial Analyst | Jobaaj Investment Banking Student

15 Min 22 Sec

Joining As a Financial Analyst | Jobaaj Investment Banking Student

18 Min 30 Sec

Offer Letter From Factset | MNC - 12k Employees | Jobaaj Investment Banking Student

36 Min 36 Sec

Non-tech background to BUSINESS ANALYST Journey || Jobaaj Data Student

14 Min 37 Sec

Khushi Yadav || Restarting the Career after 5 Years of Career Gap || Jobaaj Data Student

20 Min 45 Sec

Decoding the Interview Process After failing in 40+ Interviews || Jobaaj Data Student

18 Min 50 Sec

Offer Letter From Preqin | Jobaaj Investment Banking Student

27 Min

Fresher Data Analyst - Multiple offers from MuSigma & Expand my business

5 Min 49 Sec

Jobless to Data Analyst Journey || CTLP student

11 Min 6 Sec

Mechanical Engineering to Data Analyst Journey || Jobaaj Data Student

9 Min 28 Sec

Data Analyst - Career Switched Successfully || Jobaaj Data Student

10 Min 33 Sec

Jobless to Power BI Developer Journey || Jobaaj Data Student

10 Min 49 Sec

B.Com - Financial Analyst Journey :: CTLP Student

13 Min 23 Sec

Customer Support to Data Analyst Journey :: CTLP Student

17 Min 19 Sec

Journey from Jobless to a Data Scientist :: CTLP Student

13 Min 26 Sec

Fresher to Sales Analyst Journey :: CTLP Student

5 Min 47 Sec

Who is this program for?

Students

Are you a student who wants to break into finance after 12th grade or after graduation but doesn’t know how? Fear not. This investment banking course is easy enough for beginners to understand while helping them learn critical finance skills, helping them stand out from their peers, and getting a jump start in their careers!

Freshers

Are you a fresh graduate with no plan? Do you find finance interesting? Then this investment banking course online is for you. Learning industry-relevant skills will arm you with the necessary technical skills and help you get your dream job!

Working Professionals

Do you daydream of a successful career in finance but are stuck in a dead-end job? No worries. This banking and investment courses, you can ensure a smooth career shift into the exciting world of finance!

Finance Professionals

Are you a finance professional who wants a pay hike? We’ve got you covered. Get a refresher on your basics while learning advanced concepts and developing skills that are in-demand today to get that promotion and hike you want!! This diploma in investment banking is for you

Hurry! Only few seats left.

You don’t need an MBA/CFA to get into Investment Banking!!

Yes, You don’t need an MBA in Investment Banking, all you need is the right concepts, a good network, industry-relevant skills, a certified mentor, and some experience in the field.

Check out the investment banking course detail with this extensive roadmap!

Investment Banking Overview

- Introduction & History of Investment Banking

- Core areas of Investment Banking Activity

- Investment Banking Strategies

- Dates & Logical Functions

- Capital Markets – Equity & Debt (IPO, SEO, etc.)

- Advisory Services – M&A and Restructuring

- Pivot Tables

- Trading & Brokerage

- Asset Management

- Capstone Project

Corporate Finance: Practical Aspects

- Mastering Time Value of Money using Excel

- Cost of Capital: Dealing with challenges in the practical world

- Capital Budgeting Techniques: Applied on project

- Key Concepts: Free Cash Flow, Enterprise value, etc.

- Valuation Techniques

- Capstone Project

Financial Statements Analysis

- Interpreting FS of Listed Companies

- Cash Flow statement

- Computing Depreciation using Excel formulae

- Working capital: Practical aspects

- Capital Markets – Equity & Debt (IPO, SEO, etc.)

- Ratio Analysis: Forming Basis for Comparables Valuation

- DuPont Analysis

- Common-sizing

- Asset Management

- Capstone Project

Building Financial Models

- Financial Modeling Process

- Best Practices in Financial Modeling

- Build a model from a Blank Excel sheet

- Projection of financial statements

- Inter-linking the statements

- Sensitivity Analysis

- Football Field Chart

STOCK MARKET THE BEGINNING

- Introduction To Markets

- Introduction of Stock Market

- Next Step In Stock Market

- Corporate Actions & Its Impact On Stock Prices

- Introduction To Derivatives

- Introduction To Trading

- Getting Familiar With Trading Terminal

- Introduction To Charts

TECHNICAL ANALYSIS

- Price Action Concept

- Candlestick Patterns & Forms

- Types of Trends

- Support & Resistance Concept

- Price Action Strategies

- What are Breakouts & Reversals?

- Time Frame Analysis

- & much more......

Excel A-2-Z

- Basics of Excel

- Formatting Data in Excel

- Sort & Filter Option

- Dates & Logical Functions

- Everything about LOOKUP Formulas

- Conditional Aggregation & Formatting

- Pivot Tables

- Analysis using What-If

- Report Consolidation

- Capstone Project

Data Analysis via Pivot Tables

- Getting Started with Pivot Tables

- Formatting Data with Pivot Tables

- Sorting, Grouping and Filtering Data

- Pivot Table Calculated Values & Fields

- Visualization using Pivot Tables

- Excel Pivot Table Case Studies

- Capstone Project

Visualization in Excel

- Getting Started with Visualization

- Data Visualization Best Practices

- Excel Chart Formatting & Customization

- Mastering Excel Charts and GraphsI

- Making Dashboard on Real World Data

- Amazon Data Dashboard

- Election Comission Data Dashboard

- Wrapping Up

- Capstone Project

Mastering Excel VBA & Macros

- Starting via First Macro

- The object Model

- Working with Variables

- Controlling Flow of Code

- Working with Arrays

- Working with Files, Folders & Text Files

- Interacting with Other Applications

- Workbook and Worksheet Events

- Working with Userforms & ActiveX Controls

- Creating Custom Functions

- Capstone ProjectsI

Investment Banking Program Highlights And Features

Course Pricing

Begin your finance industry career journey with our CIB Course, offering interactive training and mentorship.

Apply now to avail the discounted price

Discounted price available for limited time slots.

0

days0

hours0

minutes0

seconds68% started a new career after completing these courses

45% got a tangible career benefit from this course

28% got a pay increase or promotion

Digital Certificate of Achievement on completion of the program

Hurry! Only few seats left.

🌟 14000+ Investment Banking jobs available on our Jobaaj job portal! 🌟

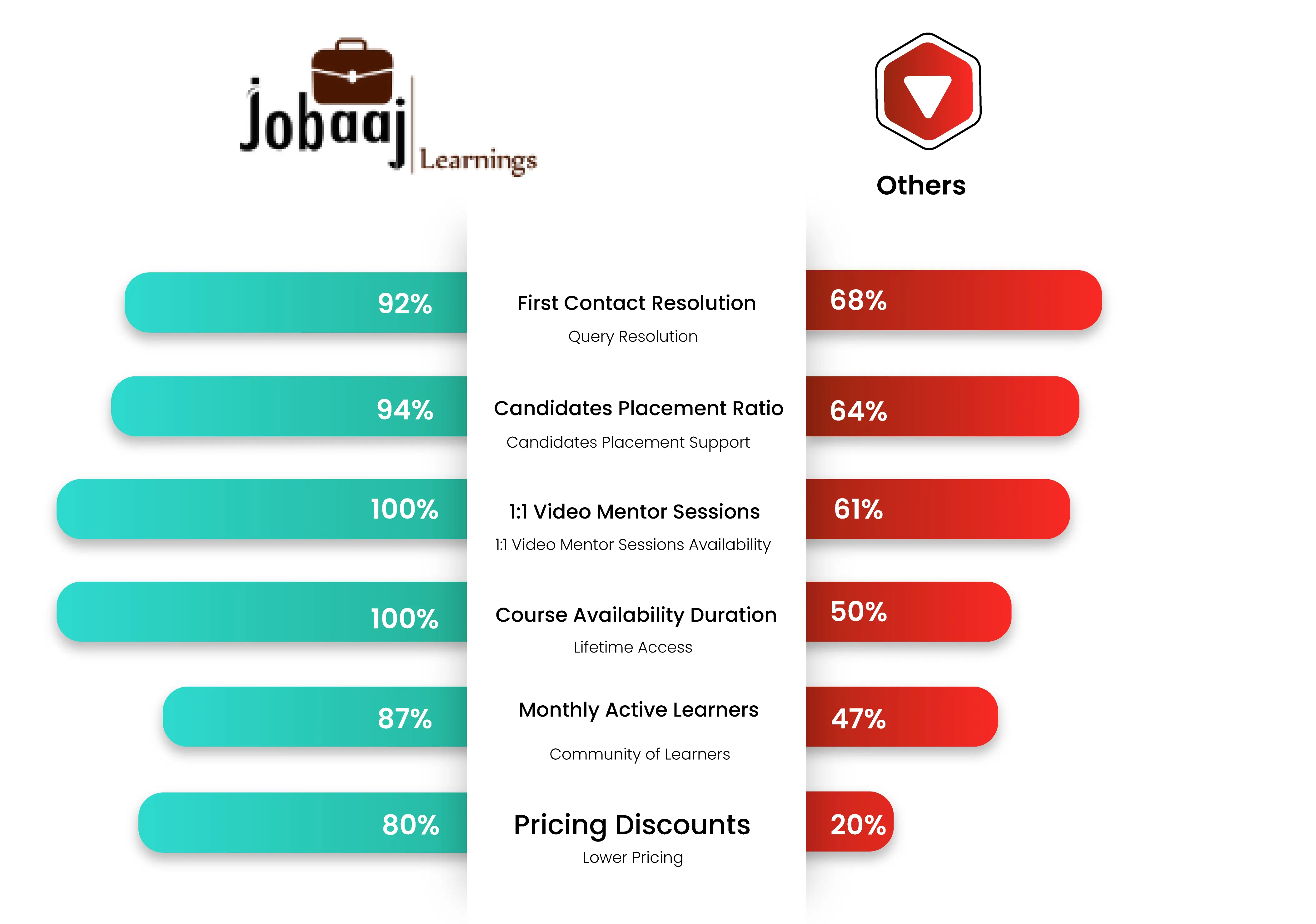

Comparative analysis of Jobaajlearnings and Other platforms

Bonus

(Only for next few people)

FAQs: Here’s everything you may ask...

Can a CA student become an investment banker?

How much time do I need to put in for the course ?

Can I make a career in finance industry after completing this program?

Is this course made of live sessions or recorded lectures?

Is there a certification or accolade at the end of this program?

What happens once I apply for the Program?

What is the duration of the Investment Banking course?

What are the investment banking course fees?

Hurry! Only few seats left.