Think of the 3-Statement Model like an X-ray for a company — it lets investment bankers see the full picture of how a business really works. It’s more than just numbers on a spreadsheet; it helps them understand a company’s financial health, plan for the future, and make smart decisions on big deals worth millions or even billions.

What is the 3-Statement Model?

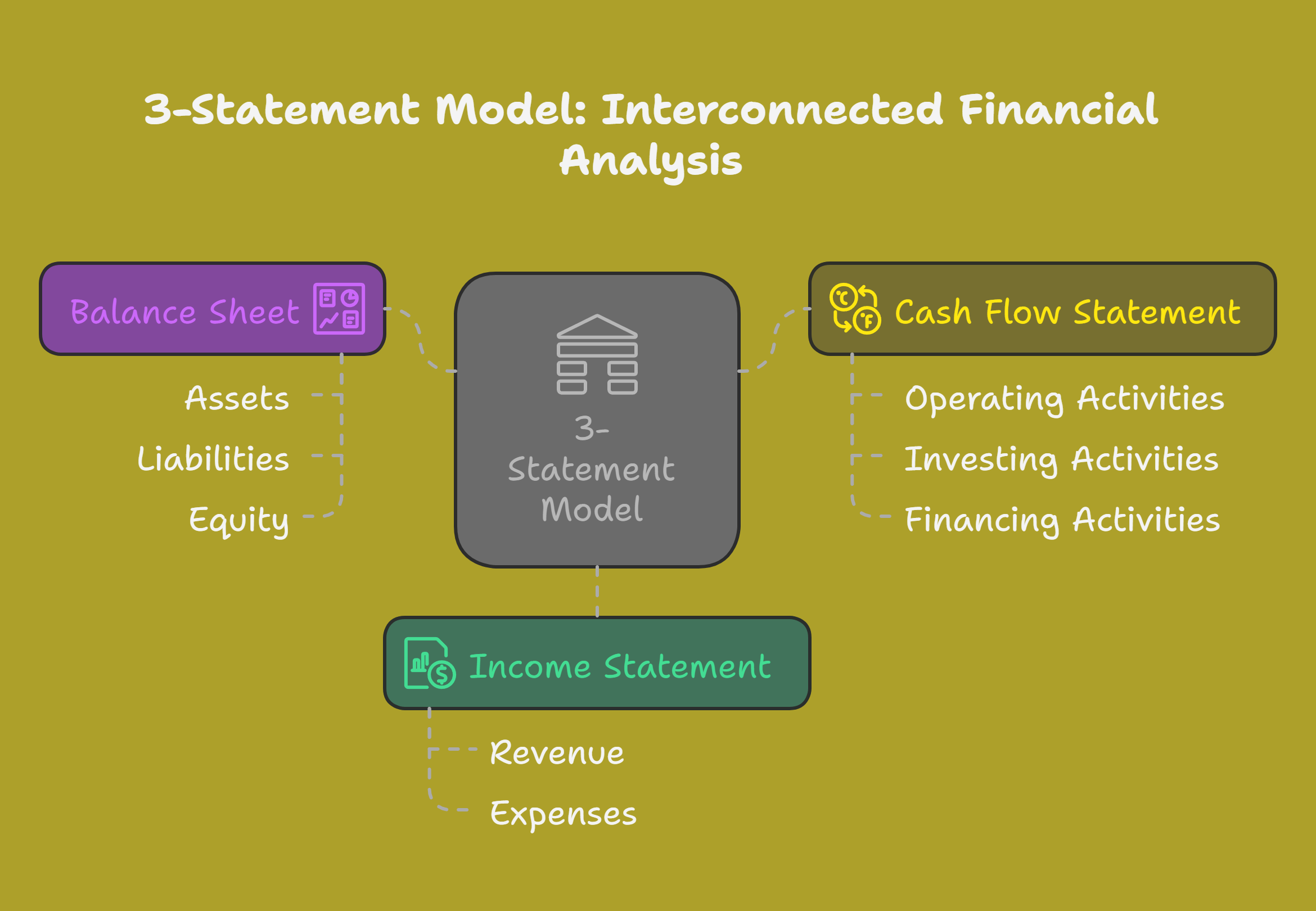

The 3-Statement Model, a cornerstone of financial analysis, links the income statement, balance sheet, and cash flow statement. This interconnectedness allows for a holistic view, revealing how operational decisions ripple through a company's financials. Think of it like a complex clockwork mechanism, where each gear (statement) influences the others in a synchronized dance.

The Income Statement: A Story of Profitability

The income statement, often called the profit and loss (P&L) statement, tracks a company's financial performance over a specific period. It reveals the top line (revenue), subtracts the cost of goods sold and operating expenses, and arrives at the bottom line – net income. This is the narrative of a company's profitability, a story told in dollars and cents.

The Balance Sheet: A Snapshot in Time

The balance sheet is a snapshot of a company's financial health at a particular point in time. It presents the fundamental accounting equation: Assets = Liabilities + Equity. This elegantly simple equation captures the essence of a company’s resources, obligations, and ownership structure. Imagine a perfectly balanced scale; it represents the delicate equilibrium a company strives to maintain.

The Cash Flow Statement: Tracing the Flow of Cash

The cash flow statement, arguably the most crucial of the three, tracks the movement of cash, both in and out, of a company. It categorizes these flows into operations, investing, and financing activities. This statement answers the fundamental question: where is the cash coming from, and where is it going? For an investment banker, understanding cash flow is akin to following the lifeblood of a business.

How Investment Bankers Use the 3-Statement Model

Investment bankers wield the 3-Statement Model like a surgeon uses a scalpel – with precision and purpose. They build these models, often using Excel, not just to understand a company’s current financial state, but to project its future performance. These projections inform critical decisions, such as valuations for mergers and acquisitions, or determining the feasibility of an IPO.

- Valuation: By projecting future financial performance, investment bankers can estimate a company's intrinsic value, a critical component in deal negotiations.

- Scenario Planning: The model allows for "what-if" analyses, exploring the impact of different market conditions or strategic decisions on a company's financial health.

- Due Diligence: In M&A transactions, the 3-Statement Model is a cornerstone of due diligence, helping to identify potential risks and opportunities.

Beyond the Numbers: The Human Element

While the 3-Statement Model is a powerful analytical tool, experienced investment bankers recognize that it’s not just about crunching numbers. It’s about understanding the story behind the numbers. For example, a dip in revenue might reflect a broader industry downturn or a company-specific challenge. The model provides the framework, but human judgment and insightful interpretation give it life.

I’ve seen firsthand how a thorough understanding of the 3-Statement Model can unlock hidden value. In one instance, our team was advising on a potential acquisition. While the initial numbers seemed underwhelming, a deeper dive into the cash flow statement revealed a significant opportunity to improve working capital management, ultimately boosting profitability and justifying a higher valuation.

Conclusion: More Than Just a Model

The 3-Statement Model is far more than just a spreadsheet; it’s a dynamic tool that empowers investment bankers to make informed decisions, navigate complex transactions, and unlock opportunities in the financial landscape. Mastering this model is not just about technical proficiency; it's about developing a deep understanding of how businesses operate, how financial statements interact, and how to translate numbers into actionable insights. This is the art of finance, where numbers tell a story, and the 3-Statement Model serves as the key to unlocking its secrets.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.