In the world of stock market investing, there are numerous strategies available to traders and investors. One such strategy that has gained popularity for its potential to generate consistent income and reduce risk is the covered call option strategy. This strategy is well-suited for investors who are looking to enhance their portfolio returns while still maintaining a relatively conservative approach.

In this blog post, we will explore the covered call options strategy, its mechanics, advantages, and considerations to help you make informed investment decisions.

What is a Covered Call Option?

A covered call option is an options trading strategy that combines stock ownership with the sale of a call option. It involves two primary components:

Stock Ownership:

As an investor, you must own the underlying stock in your portfolio. This stock ownership provides a "cover" for the call option you are selling.

Call Option Sale:

Simultaneously, you sell (write) a call option on the same stock you own. This call option gives the buyer the right (but not the obligation) to purchase your stock at a specified strike price before a predetermined expiration date.

Mechanics of the Covered Call Strategy

Let's break down the mechanics of a covered call strategy step by step:

- Stock Purchase: You start by purchasing shares of a stock you want to own in your portfolio.

- Call Option Sale: Once you own the stock, you sell a call option on those shares. The call option specifies the strike price at which the buyer can purchase your shares and the expiration date when the option contract expires.

- Premium Collection: In exchange for selling the call option, you receive a premium from the buyer. This premium provides immediate income to your portfolio.

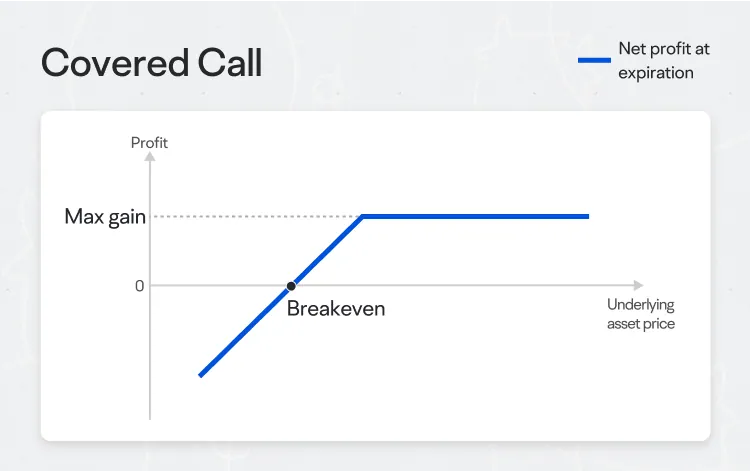

- Obligations and Risks: By selling the call option, you obligate yourself to sell the shares at the strike price if the option buyer chooses to exercise the option. While you receive a premium, your potential for additional gains from the stock's price appreciation is capped at the strike price.

Let's take an example of the covered call options strategy with a practical example:

Scenario: You are an investor who owns 1000 shares of a Company currently trading at Rs. 395 per share. You believe that the stock is likely to remain relatively stable in the short term but don't expect significant price increases. You want to generate additional income from the shares while maintaining ownership. To achieve this, you decide to implement a covered call strategy.

Step 1: Stock Purchase: You already own 1000 shares of the Company, purchased at an average price of Rs 320 per share. Your total investment (1000 shares * 320 per share).

Step 2: Call Option Sale You decide to sell a covered call option on the 1000 shares with the following details:

- Call Option Strike Price: Rs 395

- Call Option Premium: Rs 50 per share

- Call Option Expiration Date: 45 days from today

When you sell the call option, you receive a premium of Rs 50000 (1000 shares * 50 per share). This premium represents immediate income to your portfolio.

Step 3: Premium Collection You now have Rs 50000 in premium income from selling the call option. This is yours to keep, regardless of the outcome of the option.

Step 4: Obligations and Risks By selling the call option with a strike price of Rs 395, you have obligated yourself to potentially sell your 1000 shares of Rs 395 per share if the option buyer chooses to exercise the option. This means that if the company's price rises above 395 and the option is exercised, you will sell your shares for 395 each, missing out on potential gains if the stock goes even higher.

Possible Outcomes:

- Shares remain Below 395: If, at expiration, is trading below Rs 395, the call option will expire worthless, and you will keep both the premium income of 50,000 and 1000 shares.You can then decide to sell another call option or continue holding the stock.

- Share Rises Above Rs 395 but Not Exercised: If rises to, let's say, 405, but the option is not exercised by the buyer, you will still keep your shares. You keep the 50,000 premium and can sell another call option if you choose.

- Share Rises Above Rs 395 and Is Exercised: If the price rises above 395, and is exercised, you will be obligated to sell your 1000 shares at 395 each. You still keep the 50,000 premium, but you miss out on any potential gains above 395 per share.

In all, the covered call strategy in this example generates immediate income while allowing you to maintain ownership of shares. However, it also limits your potential for gains if the stock price surpasses 395 strike price. This strategy is particularly useful in neutral or slightly bullish market conditions when you believe the stock is unlikely to experience significant price increases in the short term.

Advantages of Covered Call Strategy

- Income Generation: The primary advantage of the covered call strategy is the immediate income generated from selling call options. This income can supplement your investment returns or provide a buffer against potential losses.

- Reduced Risk: Owning the underlying stock provides a safety net, as you already own the asset you might have to sell. This reduces the risk compared to simply selling naked call options, where the potential loss is unlimited.

- Enhanced Portfolio Returns: Covered calls can help you enhance your overall portfolio returns, especially in sideways or mildly bullish markets.

- Customizable Strategy: You can tailor the strategy to your risk tolerance and market outlook by selecting different strike prices and expiration dates.

Considerations and Risks

While covered calls offer several benefits, it's essential to understand the associated risks and considerations:

- Limited Profit Potential: By selling call options, you cap your potential profit at the strike price. If the stock's price increases significantly, you may miss out on higher gains.

- Stock Assignment Risk: If the call option buyer decides to exercise their option, you must sell your shares at the strike price, potentially missing out on further price appreciation.

- Market Volatility: In highly volatile markets, covered calls may not provide as much downside protection, as the premiums may not offset significant stock price declines.

- Opportunity Cost: By committing to the covered call strategy, you tie up your capital in the underlying stock, limiting your ability to invest in other opportunities.

The covered call options strategy can be an effective way to generate income and manage risk in your investment portfolio. By combining stock ownership with the sale of call options, you can create a steady stream of premium income while still participating in potential stock price appreciation. However, like any investment strategy, it comes with its own set of risks and trade-offs. Therefore, it's crucial to carefully consider your financial goals, risk tolerance, and market outlook before implementing this strategy.

As with all investment decisions, it's wise to consult with a financial advisor or conduct thorough research to determine if covered calls align with your investment objectives.

Dive deeper into the dynamics of financial markets with our Technical Analysis Crash Course, perfect for enhancing your trading skills and strategy development.