Ever felt like a juggler, tossing bills and income in the air, hoping nothing drops? That's cash flow in a nutshell. It's the lifeblood of any business, big or small, from your neighborhood lemonade stand to a Fortune 500 company. Understanding it is key to survival, and mastering it? That’s the path to prosperity.

This article dives deep into the world of cash flow, explaining what it is, how it operates, and most importantly, how you can keep it healthy and strong.

What is Cash Flow?

Simply put, cash flow is the movement of money in and out of your business. Think of it as the circulatory system of your finances.

Money coming in is your "cash inflow," like payments from customers or business loans. Money going out is your "cash outflow," covering things like operating expenses and loan repayments.

Positive cash flow means more money is coming in than going out – financial breathing room. Negative cash flow? That's when more money is leaving than entering, a situation that needs attention.

How Does Cash Flow Work?

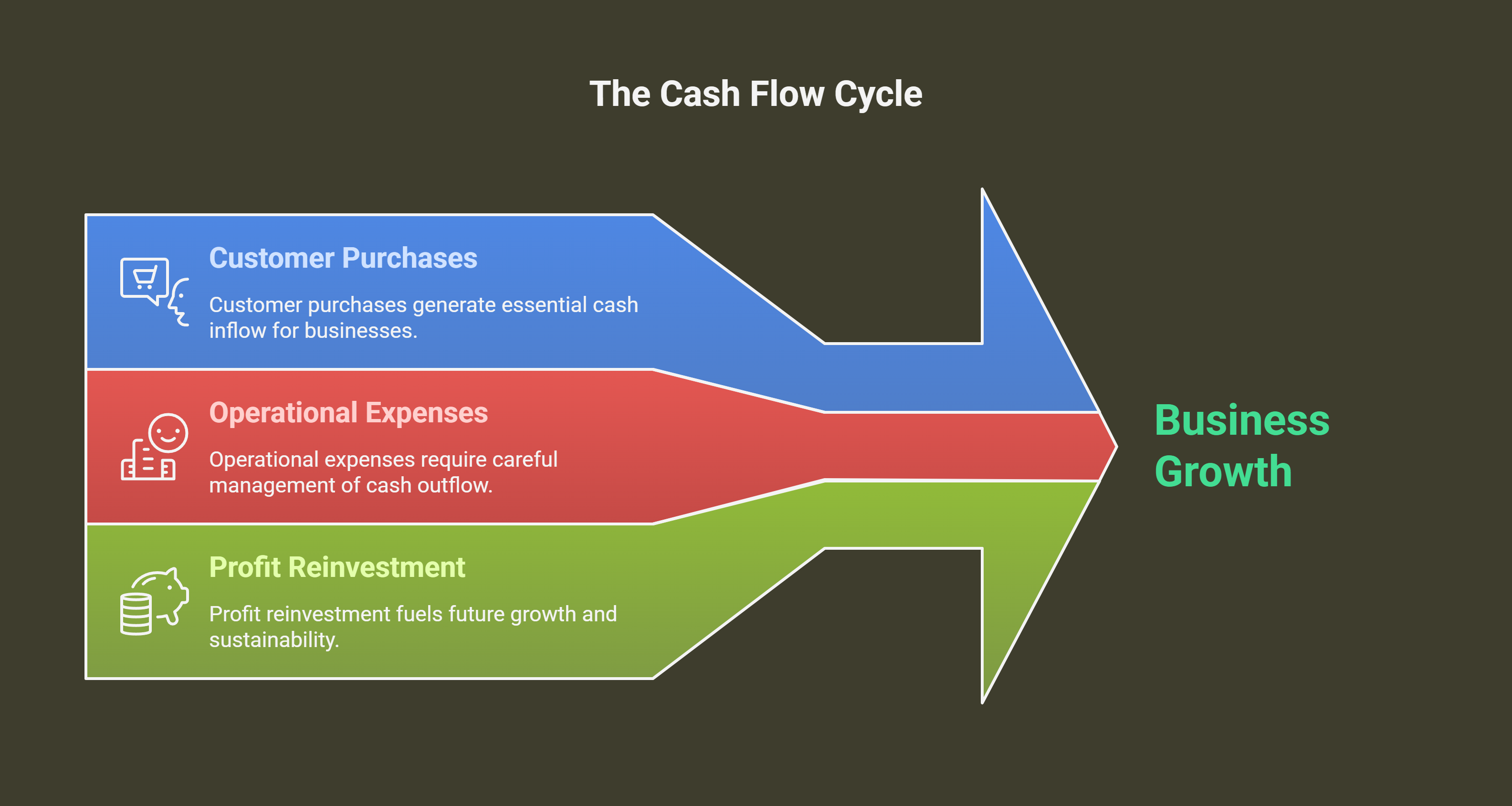

Cash flow isn’t static; it's a continuous cycle. A customer buys your product, generating cash inflow.

You use some of that cash to pay your suppliers, employees, and rent (cash outflow). The remaining cash becomes your profit, which can be reinvested or used to grow your business.

This continuous flow is crucial for daily operations, investments, and future growth. Without it, businesses can struggle to meet their immediate obligations, regardless of their profitability.

Imagine a restaurant packed with customers but unable to pay its staff because the cash hasn't come in from outstanding invoices. This scenario highlights the importance of managing cash flow effectively. Profitability doesn’t guarantee solvency.

Analyzing Your Cash Flow

Analyzing cash flow involves tracking, monitoring, and understanding where your money is coming from and where it's going.

One of the most common tools for this is the cash flow statement. This financial document provides a detailed overview of your cash inflows and outflows over a specific period.

Here’s what you can glean from a cash flow statement:

- Operating Activities: Cash from your core business operations (sales, payments to suppliers).

- Investing Activities: Cash from investments (buying or selling equipment, investments in other companies).

- Financing Activities: Cash from financing (loans, equity investments).

Beyond the statement itself, there are key metrics to consider, such as free cash flow (cash available after covering operational expenses and capital expenditures). This metric is often used to evaluate a company's financial health and its potential for growth.

By carefully examining your cash flow patterns, you can identify potential problems early on, such as consistently low operating cash flow or increasing debt levels. This early detection can help you make informed decisions, adjust your spending, and strategize for future financial stability.

Cash flow management is not just about counting dollars and cents; it's about understanding the rhythm of your business. It's about ensuring you have the resources to navigate both expected and unexpected financial tides. So, take the time to analyze, understand, and manage your cash flow. Your business's success depends on it.