Ever wondered how companies end up with those jaw-dropping valuations? It’s not magic — even if it sometimes feels that way. Behind every billion-dollar unicorn or smartly priced business deal is a well-thought-out valuation method.

This cheat sheet simplifies the top 10 techniques, giving you a clear, easy-to-understand look into how businesses are really valued in the world of finance.

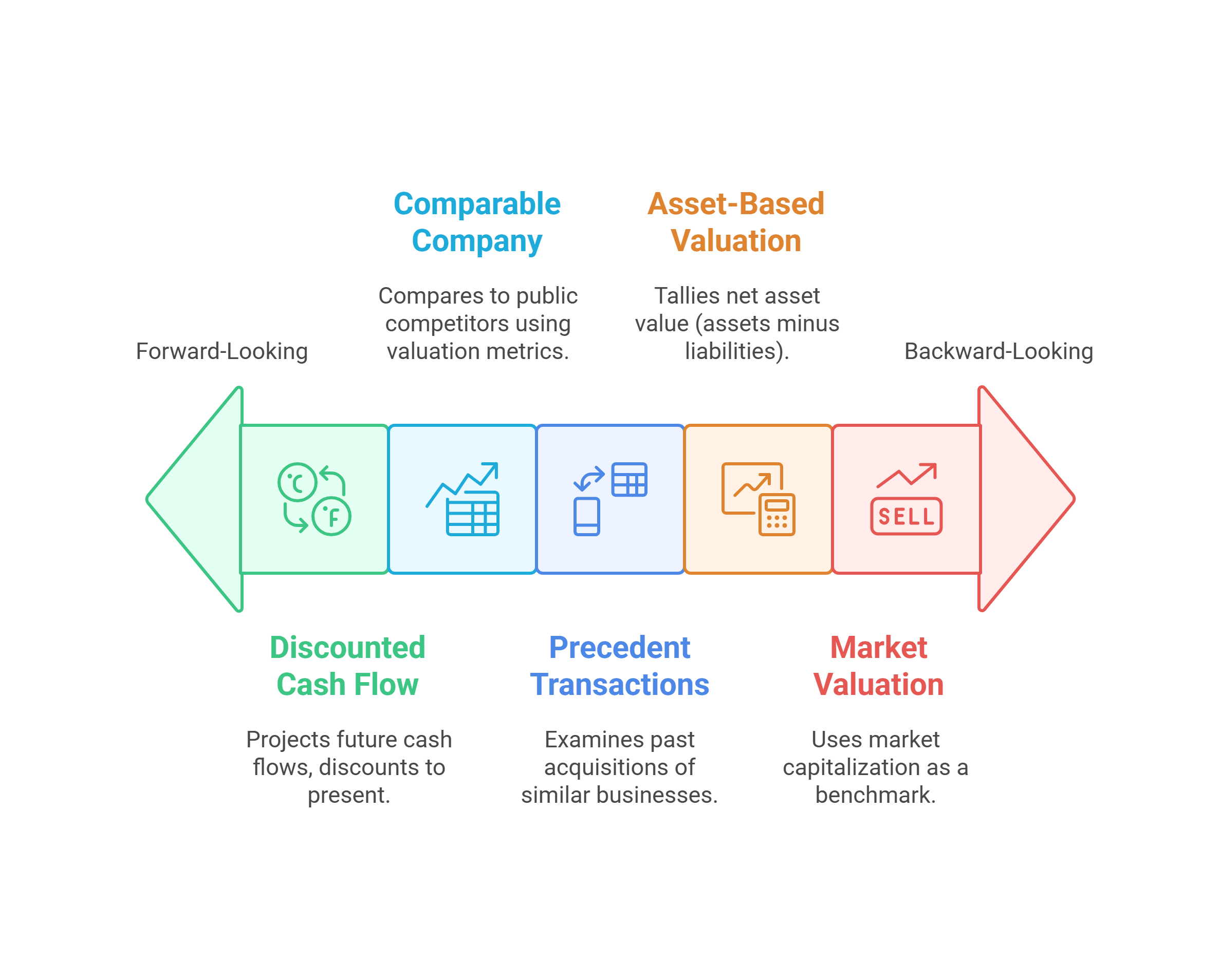

1. Discounted Cash Flow (DCF) Analysis

The gold standard. DCF projects future cash flows and discounts them back to today's value, reflecting the time value of money. Think of it like calculating the present worth of a future lottery win.

2. Comparable Company Analysis (CCA)

If similar businesses are worth X, your business might be too. CCA compares your company to publicly traded competitors using metrics like Price-to-Earnings (P/E) and Enterprise Value-to-EBITDA (EV/EBITDA). It’s a quick and dirty method, but finding truly comparable companies can be tricky.

3. Precedent Transactions

Looking back to see forward. This approach examines past acquisitions of similar businesses to estimate your company's value. It’s like checking real estate comps before putting your house on the market.

4. Asset-Based Valuation

What’s it all worth? This method tallies the net asset value (NAV) of a company—essentially, its assets minus liabilities. It's particularly relevant for businesses with substantial tangible assets like real estate or equipment.

5. Market Valuation

The wisdom of the crowd. This method uses the market capitalization of publicly traded companies—simply the share price multiplied by the number of outstanding shares—as a benchmark. It's a good sanity check but can be swayed by market sentiment.

6. Liquidation Value

The fire sale price. Liquidation value estimates how much a company’s assets would fetch if sold quickly, usually under duress. It’s a worst-case scenario valuation.

7. Book Value

What the books say. Book value is the net asset value of a company as reported on its balance sheet. It’s a simple metric, but it often fails to capture a company's true economic worth, especially for companies with significant intangible assets.

8. Multiple of Revenue

A quick and common metric, especially for early-stage companies. Revenue multiples (e.g., 2x revenue) are applied to a company's sales figures to estimate its value. Beware, revenue doesn't always translate to profit.

9. Venture Capital Method

Tailored for startups. This method focuses on the anticipated terminal value of a company after several rounds of financing. It's a highly speculative approach.

10. Berkus Method

Designed for pre-revenue startups. The Berkus Method assigns a monetary value to qualitative factors like the strength of the management team and the soundness of the business idea, up to a maximum of $2.5 million. It's more art than science.

Choosing the right valuation method depends on a myriad of factors: the stage of the company, the industry, the purpose of the valuation, and the available data. In reality, a combination of methods often provides the most accurate and nuanced picture. Remember, valuation is an art as much as a science, and experienced professionals bring invaluable judgment to the process.

Choosing the right valuation method depends on a myriad of factors: the stage of the company, the industry, the purpose of the valuation, and the available data. In reality, a combination of methods often provides the most accurate and nuanced picture. Remember, valuation is an art as much as a science, and experienced professionals bring invaluable judgment to the process.

As Warren Buffett famously said, "Price is what you pay. Value is what you get." Understanding valuation is crucial for both investors and business owners alike. It's the bedrock of informed decision-making in the financial world.