Ever wondered how investment bankers land those massive multi-million dollar deals?

It’s not luck or magic—though it can seem that way from the outside. It’s all about building strong networks, reading the market like a pro, and putting in serious hustle. In this piece, we’re pulling back the curtain to show how deals really get started.

The Network Effect

Imagine investment banking as a giant, intricate web. At the center of this web are the bankers themselves, constantly spinning connections. Their network is their lifeblood, a dynamic ecosystem of CEOs, private equity partners, lawyers, accountants, and industry insiders.

A casual lunch with a contact might reveal a company pondering strategic alternatives. A whispered conversation at a conference could lead to the next big acquisition. These seemingly informal interactions often plant the seeds for lucrative transactions.

Industry Expertise: Knowing Where to Look

Investment bankers aren’t just social butterflies; they're also industry specialists. They immerse themselves in specific sectors, from healthcare and technology to consumer goods and energy. This deep understanding allows them to anticipate market trends, identify promising companies, and spot potential deal opportunities before anyone else.

Think of it as a seasoned birdwatcher spotting a rare species in a dense forest. Their trained eye can pick out the subtle signs of a company ripe for a transaction, whether it's a struggling firm needing restructuring or a high-growth startup looking for an IPO.

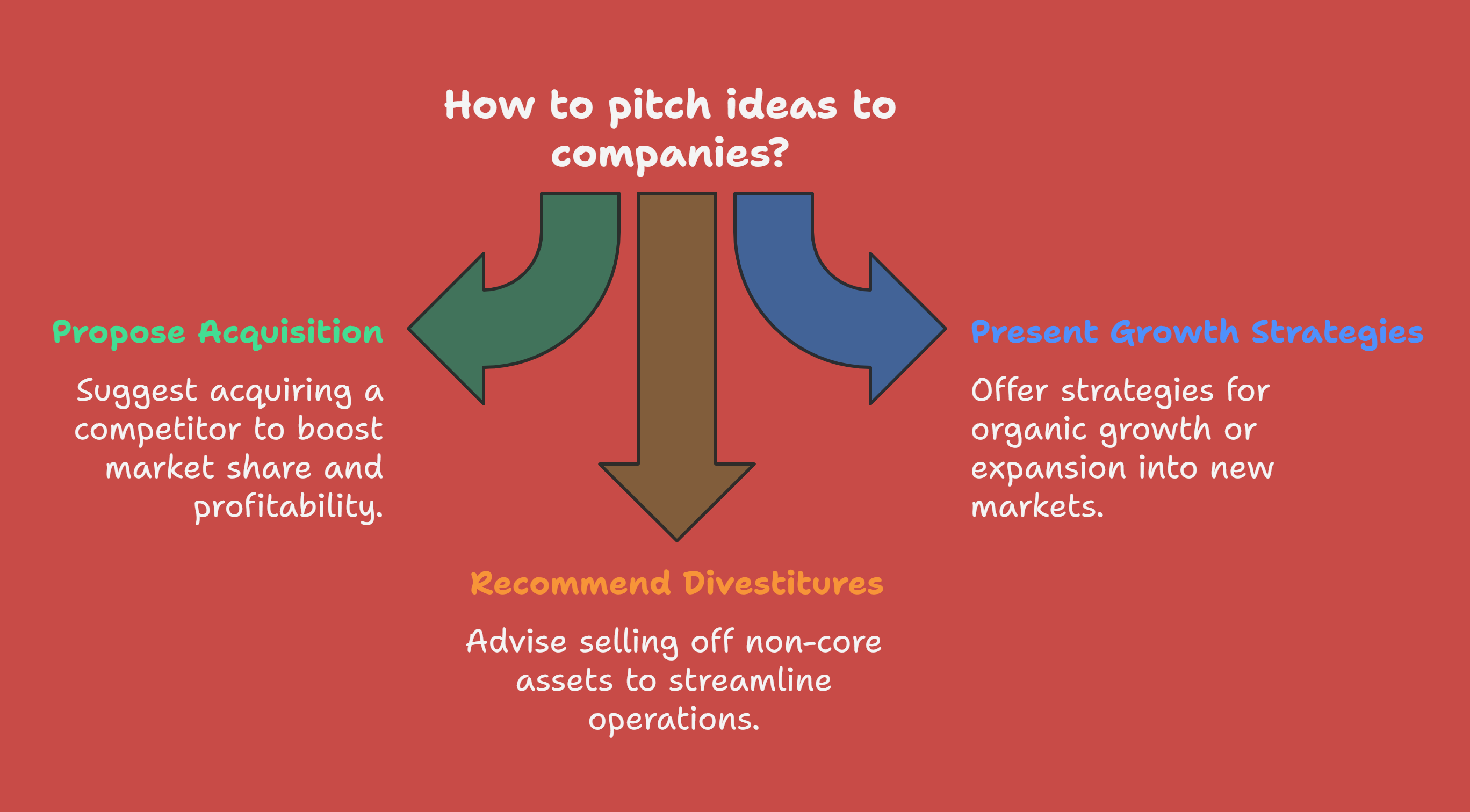

Proactive Hunting: Pitching Ideas

Investment bankers aren't just reactive; they're proactive dealmakers. They actively pitch ideas to companies, presenting compelling strategies for growth, acquisitions, or divestitures. These pitches, often backed by extensive research and financial modeling, demonstrate the banker's expertise and build trust with potential clients.

They might, for example, approach a mid-sized software company with a proposal for acquiring a smaller competitor, showcasing how the acquisition could boost market share and profitability. It's a delicate dance of persuasion and analysis, requiring a deep understanding of both the client's business and the broader market landscape.

Conferences and Industry Events

Conferences aren't just for free pens and lanyards. For investment bankers, they are crucial hunting grounds. They provide a concentrated environment for networking, intelligence gathering, and deal sourcing. A chance encounter in the coffee line can sometimes spark a billion-dollar deal. These events are a whirlwind of handshakes, business cards, and whispered conversations, all contributing to the constant flow of deal origination.

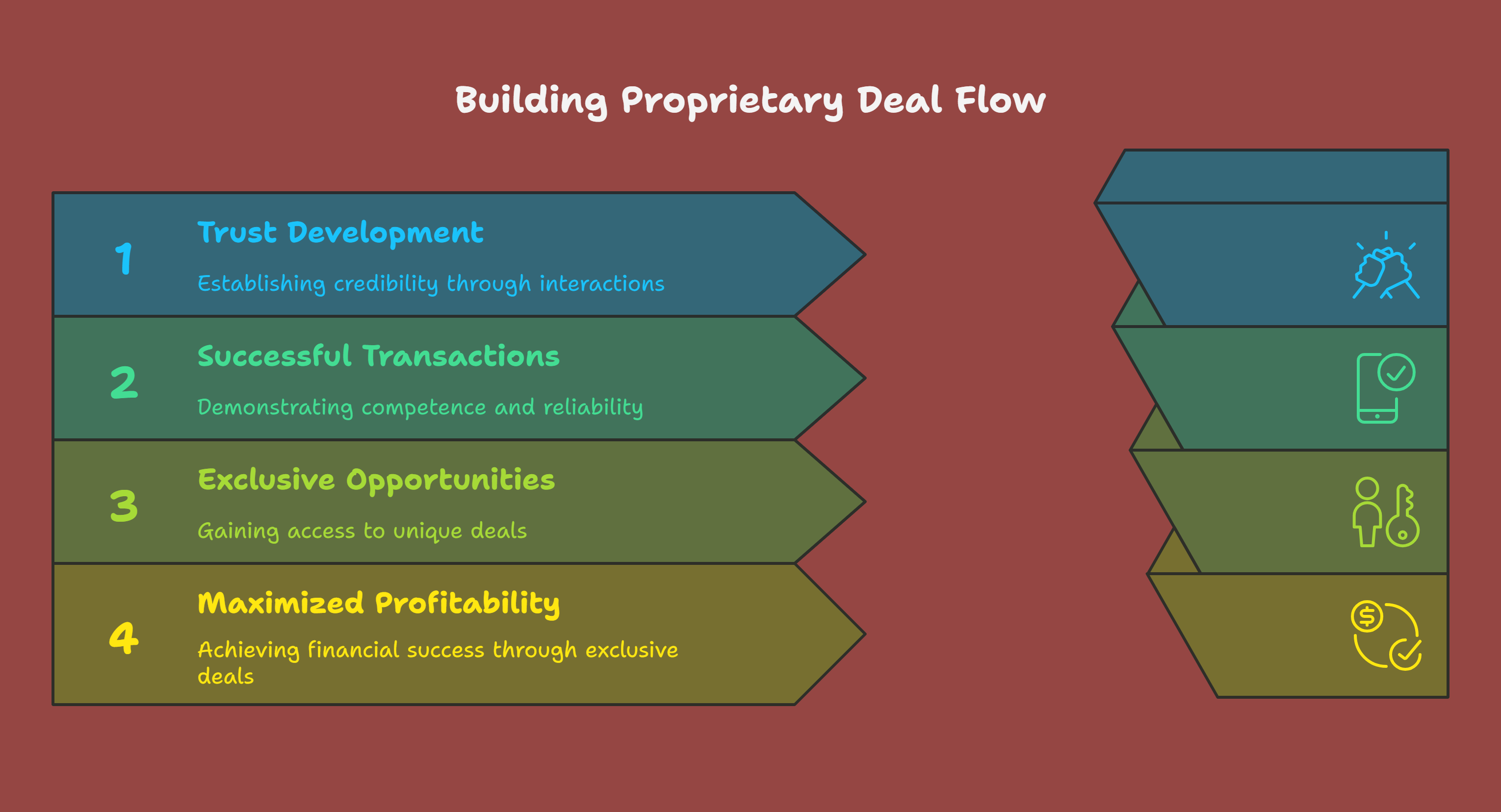

Proprietary Deal Flow: The Holy Grail

The ultimate goal for any investment bank is to develop a steady stream of proprietary deal flow – deals that come directly to them, bypassing the competitive bidding process. This often stems from strong relationships built over years of trust and successful transactions. It's like having a secret weapon, granting access to exclusive opportunities and maximizing profitability.

Conclusion: The Art of the Deal

Deal origination in investment banking is far from a simple process. It’s a dynamic blend of art and science, requiring a unique combination of networking prowess, market expertise, and relentless pursuit. It's about building relationships, understanding industries, and anticipating the next big move. So next time you hear about a blockbuster deal, remember the intricate web of activity that brought it to life.