Breaking into investment banking can feel like climbing a mountain—intense interviews, relentless networking, and the ongoing challenge to rise above the competition. But behind the slick resumes and firm handshakes lies a key differentiator: financial modeling. On Wall Street, it’s the essential language you must speak fluently.

This skill goes far beyond filling out standard templates. It’s about truly grasping how a business operates, analyzing its financial core, and forecasting its future performance. Strong financial modeling enables professionals to deliver the kind of insights that influence high-stakes decisions involving millions—or even billions—of dollars.

Building the Foundation: Key Concepts

Imagine building a skyscraper. You wouldn't start with the penthouse suite. Similarly, financial modeling starts with a robust understanding of core accounting principles. You need to be comfortable navigating the three financial statements – the income statement, balance sheet, and cash flow statement – and how they intertwine. This includes comprehending line items, calculating key ratios, and understanding the story these numbers tell.

Beyond the numbers, understanding valuation techniques is crucial. Whether it's discounted cash flow (DCF) analysis, precedent transactions, or comparable company analysis, you need to know the when, why, and how of each approach. Think of them as your toolkit, each tool serving a distinct purpose.

Mastering Excel: Your Primary Weapon

Excel is your battlefield. Mastery isn't just about knowing formulas; it's about wielding them with surgical precision. Think VLOOKUPs for seamlessly integrating data, INDEX/MATCH for advanced lookups, and nested IF statements for scenario planning. These aren't just shortcuts; they're the building blocks of complex, dynamic models.

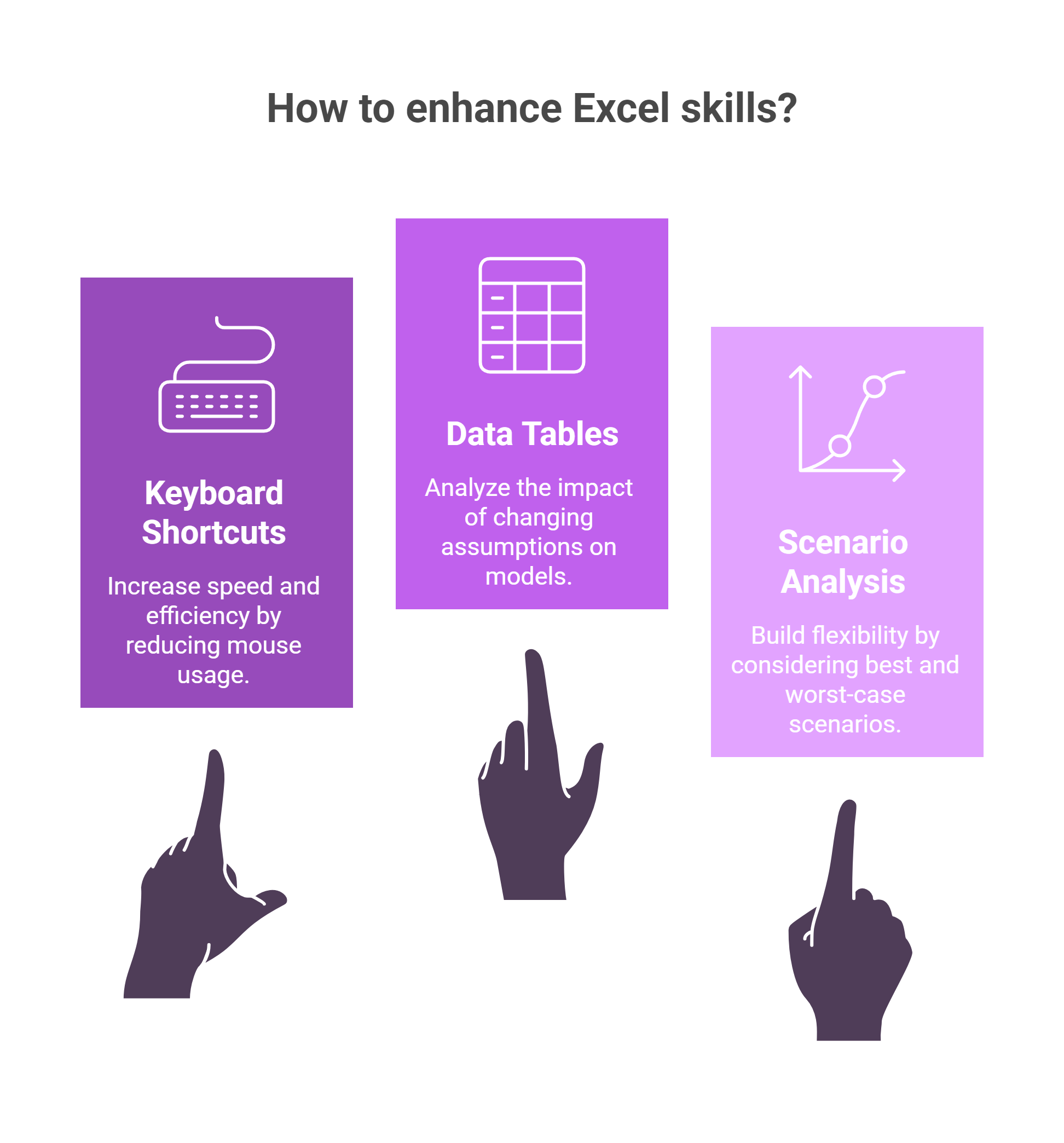

- Keyboard shortcuts: Ditch the mouse and embrace keyboard shortcuts. Your speed and efficiency will skyrocket.

- Data Tables: Quickly analyze the impact of changing assumptions. See how sensitive your model is to different interest rates or growth projections.

- Scenario Analysis: Build flexibility into your models. What happens in a best-case scenario? A worst-case? Understanding these ranges is critical.

Beyond the Spreadsheet: The Soft Skills

Technical prowess alone won’t cut it. Investment banking requires strong communication skills. You need to be able to explain complex financial models clearly and concisely to colleagues and clients, translating data into actionable insights. Remember, the best model in the world is useless if you can’t articulate its implications.

Furthermore, attention to detail is paramount. A single misplaced decimal can have significant repercussions. In this world, precision isn’t just a virtue; it’s a necessity.

Real-World Application: Putting it All Together

Imagine you’re tasked with evaluating a potential acquisition target. You’ll build a detailed financial model, projecting the target’s future performance based on various assumptions. You'll incorporate industry trends, competitive landscape analysis, and management’s projections. This model becomes the backbone of the valuation, informing critical decisions about deal structuring and negotiation.

Conclusion: Your Journey Begins

Entering the world of investment banking can feel daunting, but mastering financial modeling empowers you. It provides the analytical framework, the technical skills, and the communication tools needed to thrive in this fast-paced, high-stakes environment. So, embrace the challenge, hone your skills, and get ready to build your career, one model at a time.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.