Financial modelling and valuation has been crucially helping business and firms in the process of analysis. It is an important process where numbers and analysis combine to provide invaluable insights into the financial health and future prospects of businesses. In this blog post, we will delve into financial modelling and valuation, exploring its importance, key components, and how it can help in decision-making.

Understanding Financial Modelling:

The Purpose of Financial Modeling:

In this section, we'll discuss the fundamental purpose of financial modelling. It serves as a tool to forecast and analyze a company's financial performance, allowing stakeholders to make informed decisions about investments, acquisitions, budgeting, and strategic planning.

Key Components of Financial Modeling:

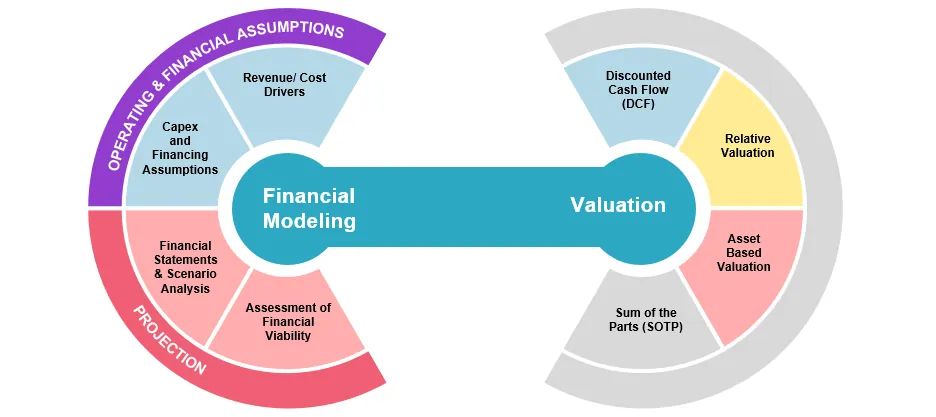

We'll explore the essential elements of a financial model, including historical and projected financial statements, assumptions, variables, and scenario analysis. Understanding these components is crucial for constructing a robust financial model that accurately reflects the dynamics of the business.

Valuation Techniques:

Importance of Valuation:

Here, we'll highlight why valuation is a critical aspect of financial analysis. Valuation provides an estimation of a company's worth, enabling investors, analysts, and other stakeholders to assess whether the current market price represents a fair value for the business.

Common Valuation Methods:

We'll dive into various valuation techniques such as discounted cash flow (DCF), comparable company analysis, and precedent transactions. Explaining each method, we'll discuss their strengths, limitations, and suitable scenarios for their application.

Building a Solid Financial Model:

Gathering and Analyzing Data:

This section focuses on the importance of collecting accurate and relevant data for financial modelling. We'll discuss primary and secondary data sources, data cleansing, and the significance of industry research and benchmarking.

Designing and Structuring the Model:

We'll provide practical tips for designing a user-friendly financial model, including clear formatting, logical flow, and appropriate use of formulas and functions. We'll also touch upon best practices for documentation and version control to ensure model integrity.

Sensitivity Analysis and Scenario Planning:

This section emphasizes the importance of sensitivity analysis and scenario planning to assess the impact of various factors on financial outcomes. We'll discuss conducting "what-if" analyses and stress testing to evaluate the model's sensitivity to changes in assumptions.

Real-World Applications:

Investment Analysis:

We'll explore how financial modelling and valuation play a crucial role in investment analysis, enabling investors to evaluate potential investment opportunities, assess risk, and make informed decisions.

Mergers and Acquisitions:

Highlighting the relevance of financial modelling in M&A transactions, we'll discuss how it helps determine the value of target companies, assess synergies, and analyze the financial impact of the deal.

Thus, financial modelling and valuation serve as indispensable tools for analyzing and understanding the financial landscape of businesses. By mastering these techniques, professionals can make well-informed decisions, mitigate risks, and uncover growth opportunities.

Remember, a solid foundation in financial modelling and valuation opens up a world of possibilities in the dynamic world of finance and business.