Imagine walking into your bank, but instead of long lines and mountains of paperwork, you're greeted with sleek interfaces and instant transactions. That's the promise of fintech, and it's shaking up the world of investment banking.

Are these two forces locked in a battle for dominance? Or can they find common ground and build something even better?

Exploring a career in Investment Banking? Apply now!

The Rise of the Fintech Disruptors

Fintech companies, armed with cutting-edge technology and a hunger for innovation, are challenging traditional investment banks. They're offering faster, cheaper, and more accessible financial services. Think about mobile payment apps, robo-advisors, and online lending platforms.

These disruptors are attracting a new generation of investors who crave convenience and transparency. They're also forcing investment banks to rethink their strategies.

This has led to some serious competition. Fintech companies are stealing market share, especially in areas like retail banking and wealth management. They're also driving down fees and pushing traditional banks to embrace digital transformation.

A Symbiotic Relationship?

But here's the twist: the relationship between fintech and investment banking isn't always adversarial. Increasingly, these two sectors are realizing they can achieve more together than apart.

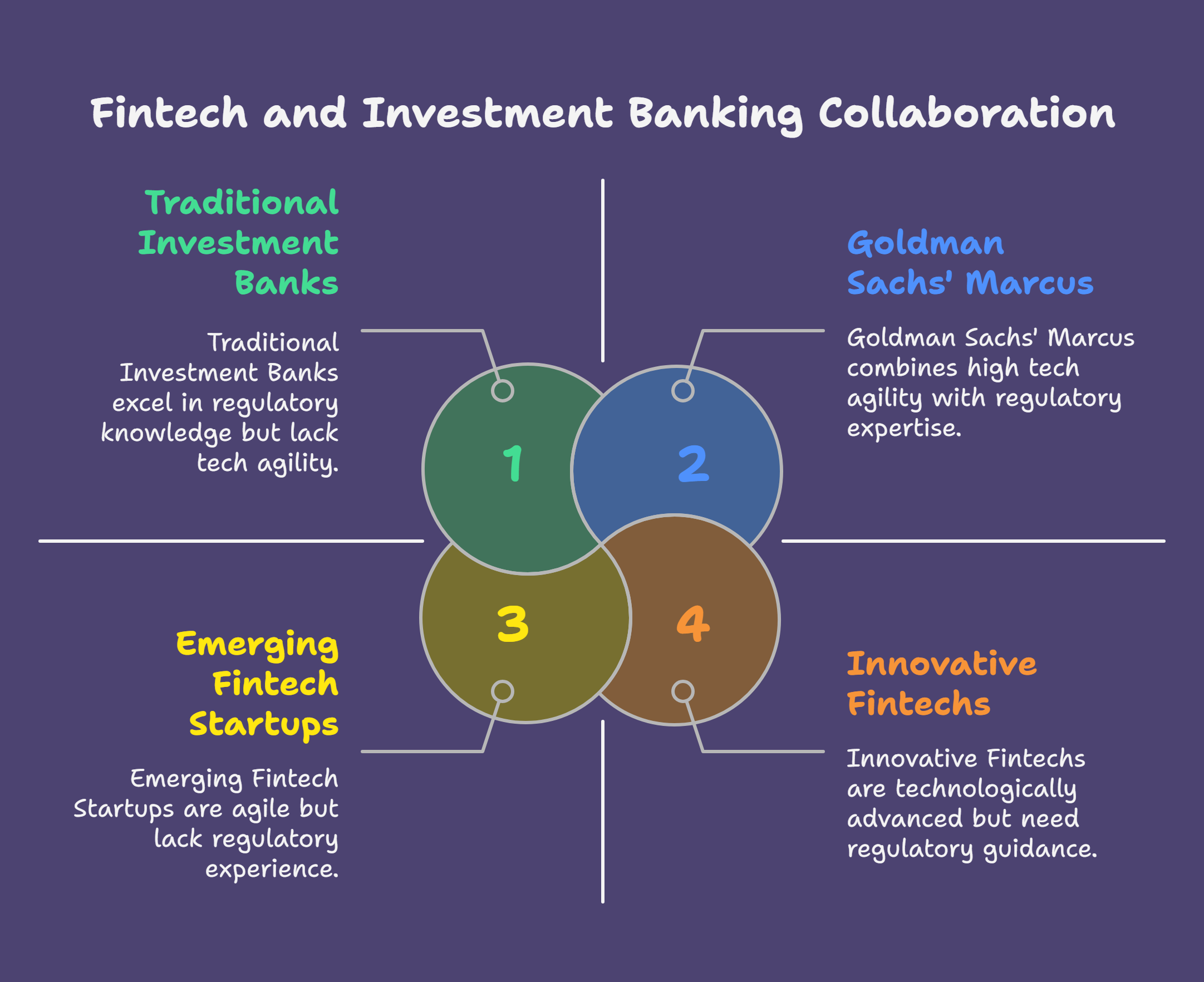

Investment banks bring a wealth of experience, regulatory knowledge, and established client relationships to the table. Fintechs, on the other hand, offer technological agility, data-driven insights, and a fresh perspective.

Many investment banks are now partnering with or even acquiring fintech companies. This allows them to tap into innovative technologies, enhance their services, and reach new customer segments. Think of Goldman Sachs' Marcus as an example.

This collaborative approach is proving beneficial for both sides. Fintechs gain access to capital, resources, and a broader network. Investment banks gain a competitive edge and the ability to adapt to the rapidly evolving financial landscape.

The Future of Finance

The future of finance likely involves a blend of traditional banking and fintech innovation. This creates a hybrid model that offers the best of both worlds: the stability and expertise of established institutions, combined with the speed and agility of technological disruptors.

We'll likely see more partnerships, acquisitions, and joint ventures between these two sectors. The lines between traditional banking and fintech will continue to blur, creating a more dynamic and customer-centric financial ecosystem.

Ultimately, the relationship between fintech and investment banking isn't a zero-sum game. It's a dance of co-evolution, where both partners learn, adapt, and thrive.

The real winners in this evolving landscape will be the customers, who will benefit from more efficient, accessible, and personalized financial services.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.