India’s investment banking scene is alive with momentum. A powerful mix of rising startups, progressive policy reforms, and a steady stream of global investments is reshaping the financial landscape. It’s no longer just about billion-dollar transactions—it’s a transformation in how corporate India approaches finance.

Gone are the days of hushed conversations in old-school boardrooms. Today’s action is fast-paced and fueled by technology, creative deal-making, and a wave of sharp, forward-thinking investors driving the future of Indian finance.

The Rise of Fintech: A New Playing Field

Fintech isn't just nibbling at the edges; it's devouring the traditional playbook. The explosion of digital payment platforms, online lending, and robo-advisors is reshaping the financial landscape. This is forcing established investment banks to adapt, innovate, or risk becoming obsolete.

I’ve seen firsthand how this disruption is playing out. Traditional banks are scrambling to partner with, or even acquire, fintech startups to stay relevant. They're investing heavily in their own digital infrastructure, trying to capture a slice of this rapidly growing pie.

IPO Boom: A Gateway to Global Capital

India's IPO market is on fire. The sheer volume of companies lining up to go public is staggering, driven by a thirst for capital and a desire to tap into global markets. This surge in IPOs isn't just creating wealth; it's democratizing access to investment opportunities, attracting a new wave of retail investors.

This boom brings its own set of challenges. Valuations are sky-high in some sectors, leading to concerns about a potential bubble. Regulatory oversight and due diligence are crucial to ensuring the long-term health of this vibrant market.

.png)

Cross-Border Deals: Bridging the Global Divide

India is increasingly becoming a magnet for foreign investment. Cross-border M&A activity is surging, as global companies seek to capitalize on India's vast consumer market and skilled workforce.

Investment banks play a pivotal role in facilitating these complex transactions, navigating the intricacies of international regulations and cultural nuances. They are the architects of these global partnerships, bridging the divide between East and West.

ESG Investing: The Conscience of Capital

Environmental, social, and governance (ESG) factors are no longer just a niche concern. They're becoming mainstream, driving investment decisions across the board. Investors are demanding greater transparency and accountability from companies, pushing them to embrace sustainable practices.

This shift towards ESG investing is transforming the role of investment banks. They're now advising companies on ESG compliance, helping them develop sustainable business models, and even structuring green bonds and other innovative financial instruments.

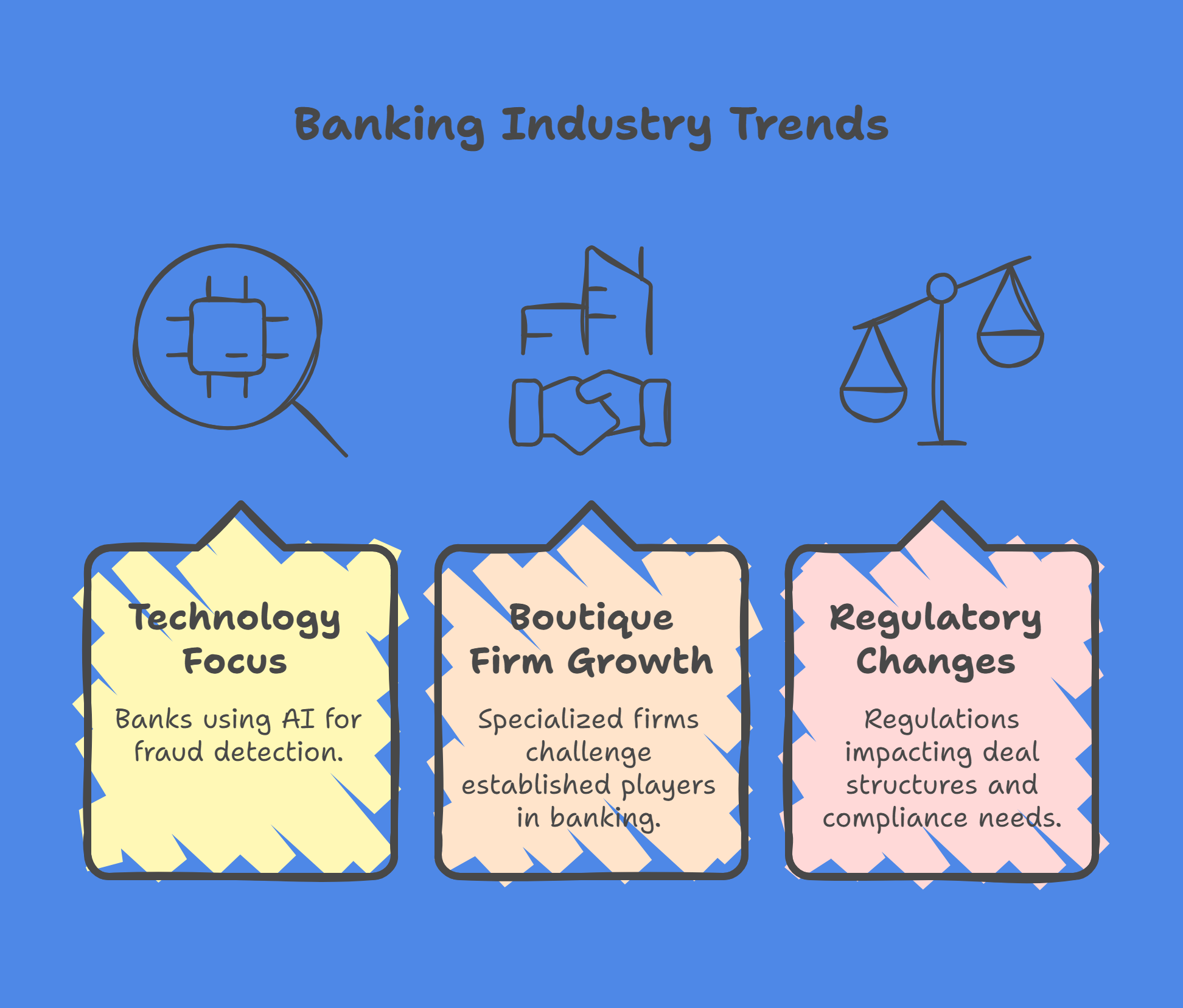

- Increased focus on technology: Banks are adopting AI and machine learning for tasks like fraud detection and risk assessment.

- Growing competition from boutique firms: Specialized firms are challenging established players by offering niche expertise.

- Regulatory changes: Evolving regulations impact deal structures and compliance requirements.

Looking Ahead: Navigating the Uncertainties

The Indian investment banking market in 2025 is a dynamic and exciting space, brimming with both opportunities and challenges. While the future holds uncertainties, one thing is clear: the only constant is change.

Those who can adapt, innovate, and embrace the evolving landscape will thrive. The future belongs to those who can navigate the complexities, anticipate the disruptions, and seize the opportunities that lie ahead. It's a fascinating time to be watching this market unfold.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.