Billions of dollars shift hands. Fortunes are made and lost. Cross-border mergers and acquisitions (M&A) are high-stakes games of chess, and investment bankers are the grandmasters.

They're not just financiers; they're strategists, negotiators, and cultural interpreters, stitching together complex deals across continents. Ever wondered how they pull it off? Let's dive into the intricate world of cross-border M&A.

Unraveling the Complexities: Due Diligence and Valuation

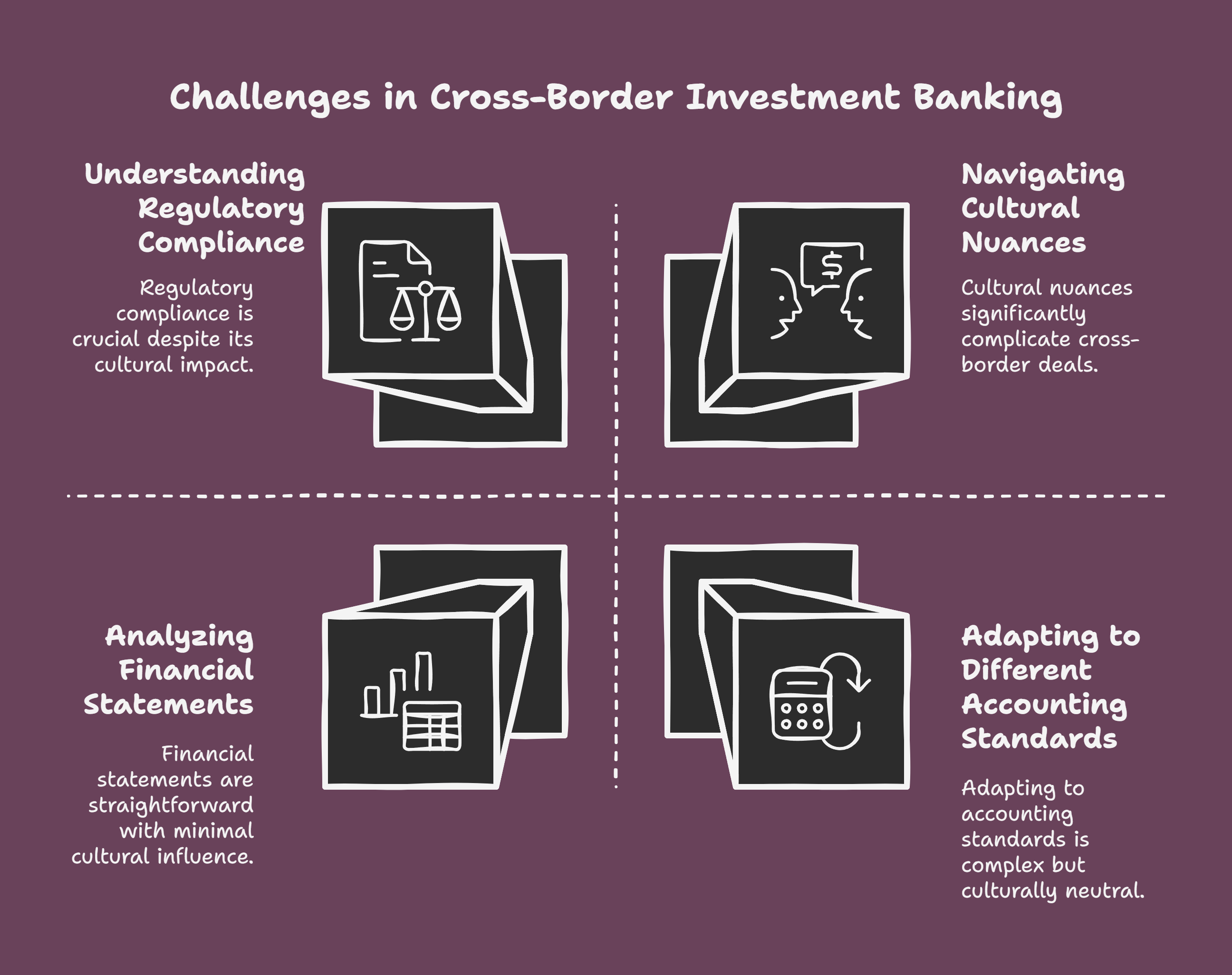

Imagine trying to value a company you barely understand, in a market you’ve never operated in. That’s the challenge investment bankers face daily. Due diligence becomes even more critical in cross-border deals. They scrutinize everything from financial statements to regulatory compliance, often navigating different accounting standards and legal frameworks.

Cultural nuances add another layer. What’s considered standard practice in one country might be a red flag in another. Experienced bankers know that overlooking these subtleties can derail even the most promising deals.

Bridging the Cultural Divide: Negotiation and Integration

Negotiation isn’t just about price. It’s about understanding cultural sensitivities, building trust, and forging relationships. Imagine negotiating with a Japanese company where directness is considered rude, or a German firm known for its meticulous approach. Investment bankers act as cultural bridges, ensuring smooth communication and mutual respect.

Post-merger integration is where many cross-border deals falter. Blending different corporate cultures, management styles, and operational processes can be a minefield. Investment bankers guide this process, helping companies create a unified vision and a roadmap for success.

Navigating Regulatory Hurdles: Legal and Financial Frameworks

Cross-border M&A transactions often involve navigating a complex web of regulations. Antitrust laws, foreign investment restrictions, and national security concerns can all create significant hurdles. Investment bankers work closely with legal experts to ensure compliance, anticipating potential roadblocks and crafting strategies to overcome them.

Currency fluctuations and foreign exchange risk add another layer of complexity. Bankers use sophisticated financial instruments to mitigate these risks, protecting their clients from potential losses.

The Human Touch: Building Trust and Relationships

Despite the technical complexities, cross-border M&A is ultimately a human endeavor. Building trust and fostering strong relationships are paramount. Investment bankers invest significant time cultivating connections with key stakeholders, from CEOs and board members to government officials and regulators.

This personal touch is what differentiates the best from the rest. It's about understanding motivations, anticipating concerns, and finding creative solutions that benefit all parties involved.

.png)

A Glimpse into the Future: Trends Shaping Cross-Border M&A

The world of cross-border M&A is constantly evolving. Geopolitical shifts, technological advancements, and changing regulatory landscapes are reshaping the playing field. Areas like ESG (environmental, social, and governance) are becoming increasingly important, influencing investment decisions and deal structures.

As businesses become more globalized, the need for skilled investment bankers will only grow. These individuals are the architects of global commerce, shaping the future of business one deal at a time. Their ability to navigate complexities, bridge cultures, and build trust will continue to be essential in the ever-evolving world of cross-border M&A.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.