The iconic campuses of Ivy League universities and Oxbridge are synonymous with academic excellence, drawing exceptional students from every corner of the world. But in an admissions process where competition is intense and every detail matters, how can you rise above the rest? Surprisingly, a background in investment banking could be the differentiator.

It’s not about flaunting financial success—it’s about demonstrating a rare mix of analytical prowess, grit, and a sophisticated grasp of the global economy. These are the attributes that top-tier universities value deeply.

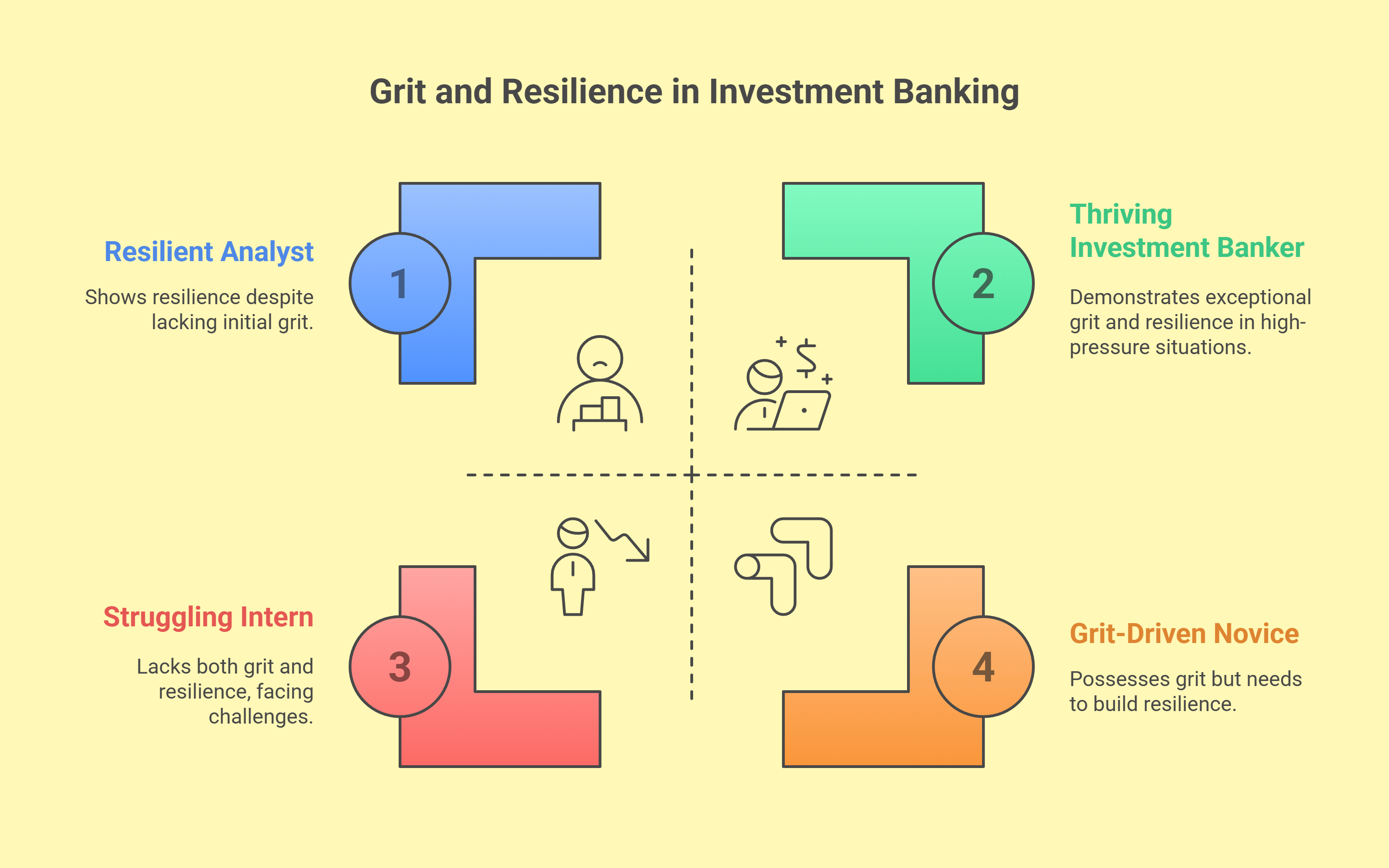

Demonstrating Grit and Resilience

Investment banking is notorious for its demanding hours and high-pressure environment. Surviving, let alone thriving, in this field demonstrates a level of grit and resilience that admissions committees find compelling.

Think about it: pulling all-nighters to close a deal, navigating complex financial models, and handling the pressure of multi-million dollar transactions. These experiences forge a work ethic and determination that sets candidates apart.

Showcasing Analytical Prowess

Investment banking requires sharp analytical skills. From evaluating market trends to building financial models, aspiring bankers hone their ability to analyze data, identify patterns, and draw insightful conclusions. These are precisely the skills that top universities seek in their students.

Developing Commercial Acumen

Imagine pitching a deal to a seasoned CEO or negotiating a complex transaction. Investment banking immerses you in the world of business, fostering a deep understanding of financial markets and corporate strategy. This commercial acumen isn't something you can learn from textbooks; it’s earned through experience.

This real-world experience demonstrates a level of sophistication and practicality that resonates with admissions committees. It shows that you're not just academically gifted, but also capable of applying your knowledge in a practical setting.

Networking and Mentorship Opportunities

Working in investment banking opens doors to a vast network of professionals, including senior executives and industry leaders. These connections can provide invaluable mentorship, guidance, and even letters of recommendation that can significantly bolster your application.

I’ve seen firsthand how a strong mentor from the finance world can shape a young person's trajectory, offering insights and advice that can be truly transformative.

Beyond the Resume: Crafting a Compelling Narrative

While the experience itself is valuable, how you present it in your application is equally crucial. Don’t just list your transactions. Tell a story. Showcase the challenges you faced, the lessons you learned, and how your experiences shaped your aspirations.

Did you work on a deal that had a significant social impact? Did you learn a valuable lesson from a senior banker? These are the kinds of details that bring your experience to life and make your application memorable.

.png)

A Word of Caution: Authenticity is Key

A short stint in investment banking won’t magically guarantee admission to your dream university. Admissions committees can spot inauthenticity a mile away. Your passion for finance, your commitment to learning, and your genuine interest in the field must shine through in your application.

Conclusion

Investment banking can be a powerful stepping stone toward gaining admission to prestigious universities. However, it's not a shortcut. It's about leveraging the demanding experience to cultivate valuable skills, broaden your perspective, and craft a compelling narrative that sets you apart from the competition. The real value lies not in the prestige of the job title, but in the transformative power of the experience itself.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.