Remember how everyone was talking about Wall Street crashing when the world shifted to remote work?

There was this huge fear that the whole financial system would just collapse. But here’s the thing: it didn’t crumble. It adapted, found new ways to keep going, and even thrived in some areas. Investment banking, which used to be all about big towers, fancy lunches, and face-to-face meetings, has totally transformed. The way people work, the tools they use, and even the roles themselves have evolved at a crazy fast pace. What seemed like a crisis turned out to be a huge opportunity for change, and now the industry is unrecognizable compared to what it was just a few years ago.

The Rise of the Remote Banker

The mahogany-paneled office isn't the only place deals get done anymore. Remote work, once a fringe concept in this demanding industry, has become surprisingly mainstream. Sure, the all-nighters still happen, but now they’re more likely to be fueled by home-brewed coffee than overpriced takeout.

This shift has had a ripple effect on junior banker roles. While the learning curve remains steep, the always-on culture is (thankfully) softening, making room for a healthier work-life balance – something almost unheard of pre-pandemic.

Tech Takes Center Stage

The pandemic accelerated the digital transformation of finance. Fintech was already disrupting the scene, but COVID poured gasoline on the fire. Now, coding skills and data analysis are no longer "nice-to-haves" but essential tools in an investment banker's arsenal.

Think about it: analyzing massive datasets, building financial models, and even executing trades—much of it is now automated. This frees up bankers to focus on higher-value tasks: client relationships, strategic advisory, and navigating the increasingly complex regulatory landscape.

Client Needs, Redefined

Client expectations have changed, too. Beyond the traditional demands of maximizing returns, companies are now prioritizing ESG (Environmental, Social, and Governance) factors, seeking investments that align with their values. This has created a surge in demand for bankers with expertise in sustainable finance and impact investing.

I recently spoke with a senior banker at a bulge bracket firm who described how client conversations now regularly delve into the societal impact of potential deals. This is a far cry from the solely profit-driven discussions of the past.

The Skills of the Future

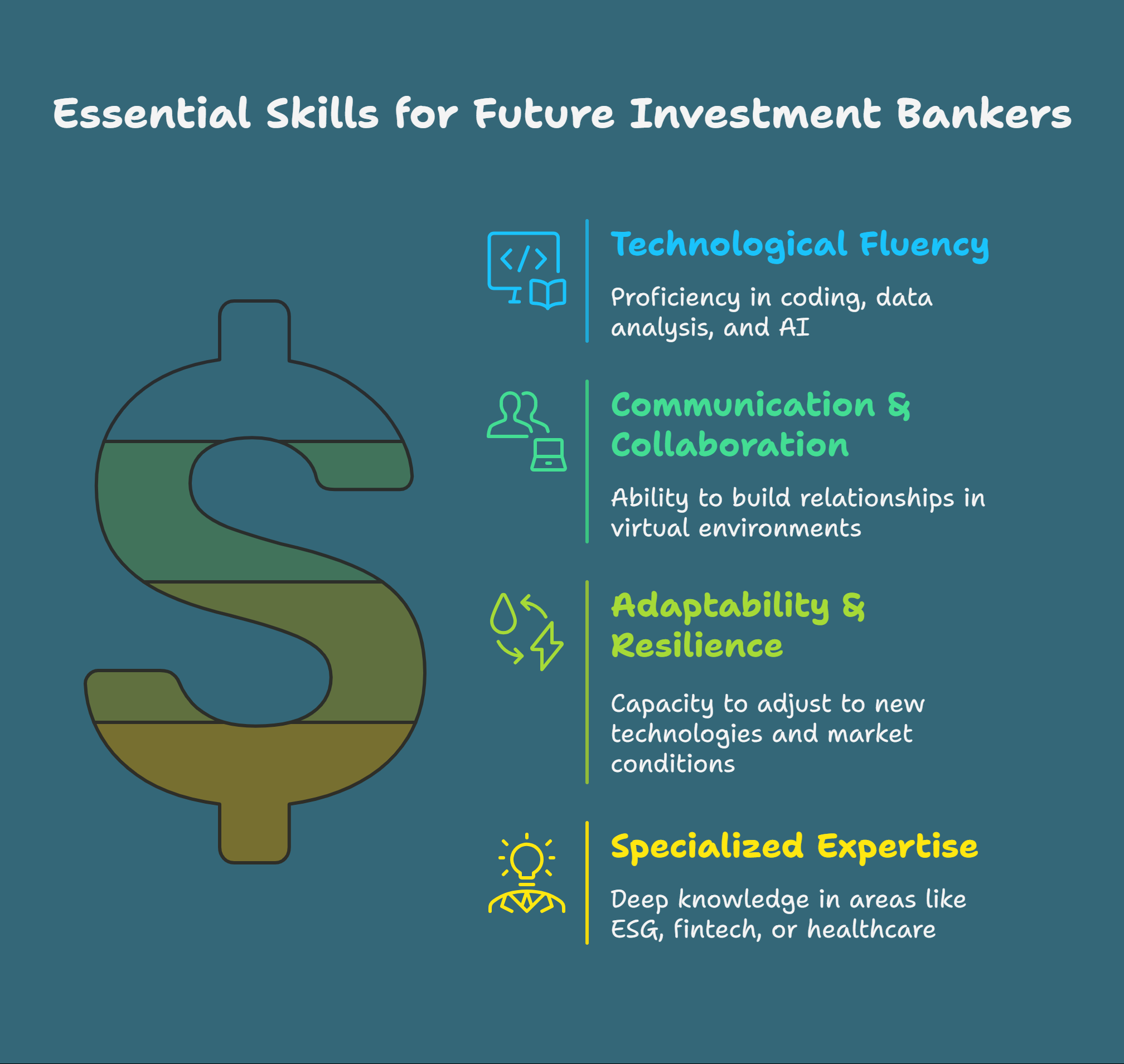

So, what does this all mean for aspiring investment bankers? The core skills – financial modeling, valuation, and transaction execution – remain crucial. However, they're no longer enough. The bankers of tomorrow need a broader skillset:

- Technological Fluency: Coding (Python, SQL), data analysis, and familiarity with AI and machine learning are increasingly valuable.

- Communication & Collaboration: Building relationships in a virtual environment requires strong communication and collaboration skills.

- Adaptability & Resilience: The only constant is change. The ability to adapt to new technologies and market conditions is paramount.

- Specialized Expertise: Deep knowledge in areas like ESG, fintech, or healthcare can provide a competitive edge.

A New Era of Finance

The post-COVID world presents both challenges and opportunities for investment banking. While the traditional image of the banker might be fading, the role itself is becoming more dynamic and impactful than ever. Those who embrace the change, hone their skills, and adapt to the evolving landscape will thrive in this new era of finance.