When people think of investment banking, they often picture sharp suits, high-stakes meetings, and massive transactions. But beneath the surface of this glamorous world lies a key skill that can make or break your success: strong math skills.

Whether you're preparing for an Associate Analyst (AA) or Analyst Intern (AI) role, your ability to work with numbers quickly and accurately is essential. It's not about mastering advanced calculus – it's about being mentally sharp and confidently applying core financial concepts, especially under pressure.

Decoding the Math Challenge: AA vs. AI

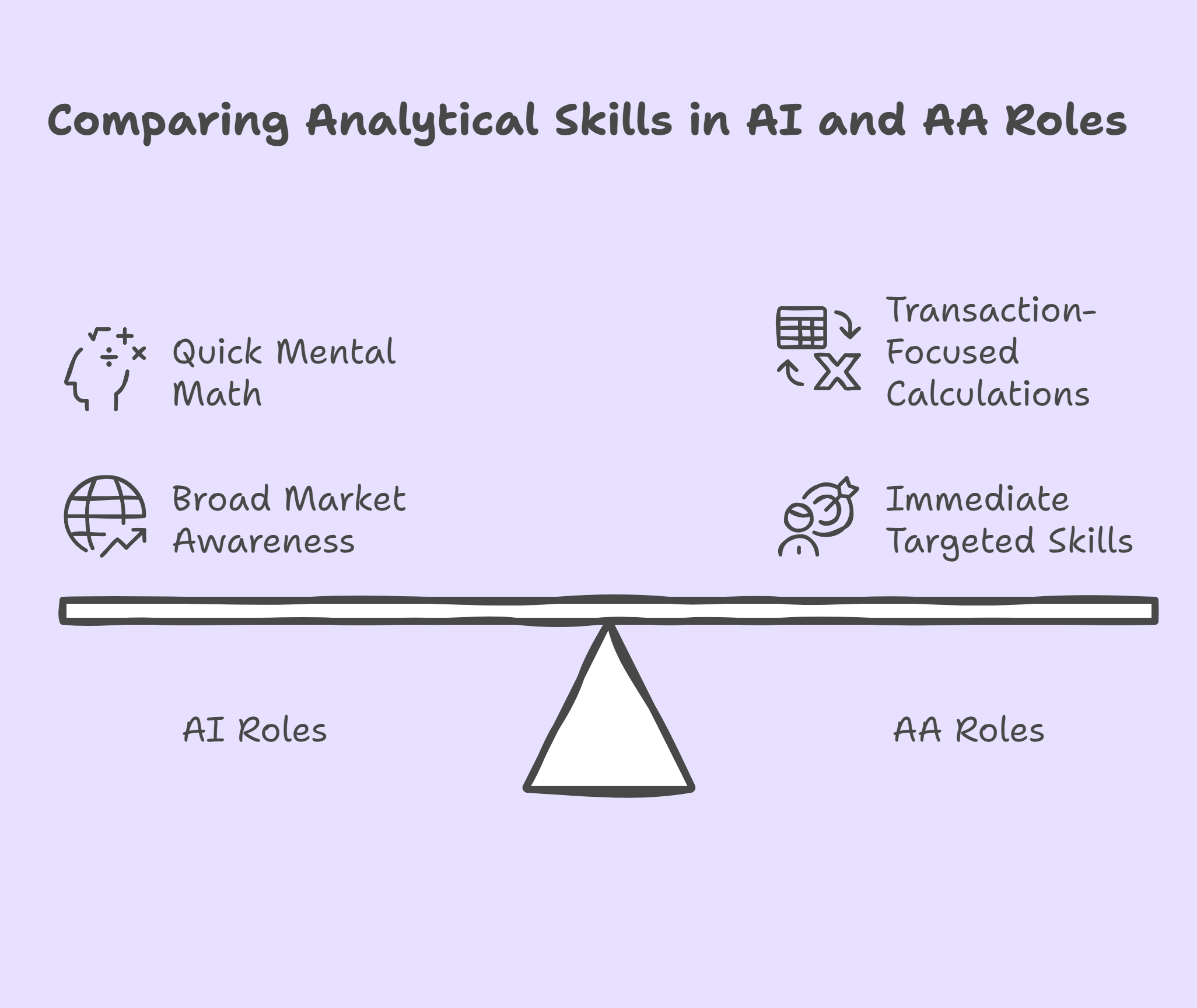

Both AA and AI roles demand strong analytical skills, but the intensity and focus vary. AI interviews, often conducted on campus, typically emphasize quick mental math and market awareness. Think calculating percentages, understanding basic valuation metrics, and demonstrating a grasp of current financial news. AA interviews, on the other hand, delve deeper into transaction-related calculations. Imagine dissecting a leveraged buyout model or working through accretion/dilution scenarios on the spot.

The difference stems from the nature of the roles. AIs are brought in for rotational programs, learning the ropes across different product groups. AAs, often hired directly after university or with some experience, require a more immediate and targeted skill set.

Sharpening Your Mental Math: The Foundation

Mental math is the bedrock. Imagine effortlessly converting fractions to decimals, calculating percentage changes, and estimating large numbers in the blink of an eye. This isn't a party trick—it's essential. Practice regularly with mental math apps or flashcards focusing on speed and accuracy.

A solid foundation in mental math empowers you to tackle more complex financial concepts. Think about quickly determining deal multiples during a discussion or assessing the potential impact of changing market conditions. The speed and precision you develop become powerful assets during the interview.

Mastering Core Financial Concepts

Understanding valuation methodologies—DCF, precedent transactions, and market comparables—is paramount. Imagine being asked about enterprise value versus equity value or calculating a weighted average cost of capital (WACC). These are fundamental tools in an investment banker's arsenal. Study these concepts diligently, aiming for a deep understanding, not just surface-level memorization.

- Valuation: Master discounted cash flow (DCF), precedent transactions, and comparable company analysis.

- Accounting: Understand the three financial statements and how they interconnect.

- Financial Modeling: Practice building simplified LBO models in Excel.

Tailoring Your Preparation: AA vs. AI

While the fundamentals remain constant, tailor your preparation to the specific role. AIs should focus on demonstrating market awareness and quickly solving basic financial problems. Stay updated on recent M&A deals, IPOs, and market trends. AAs, however, need to demonstrate proficiency in deal structuring and financial modeling. Practice building simplified LBO models and get comfortable discussing complex transaction scenarios.

One crucial tip for AAs is to deep-dive into deal tombstones and analyze the financial structure of recent transactions. This hands-on experience provides valuable insights into the real-world application of financial concepts.

Beyond the Numbers: The Soft Skills

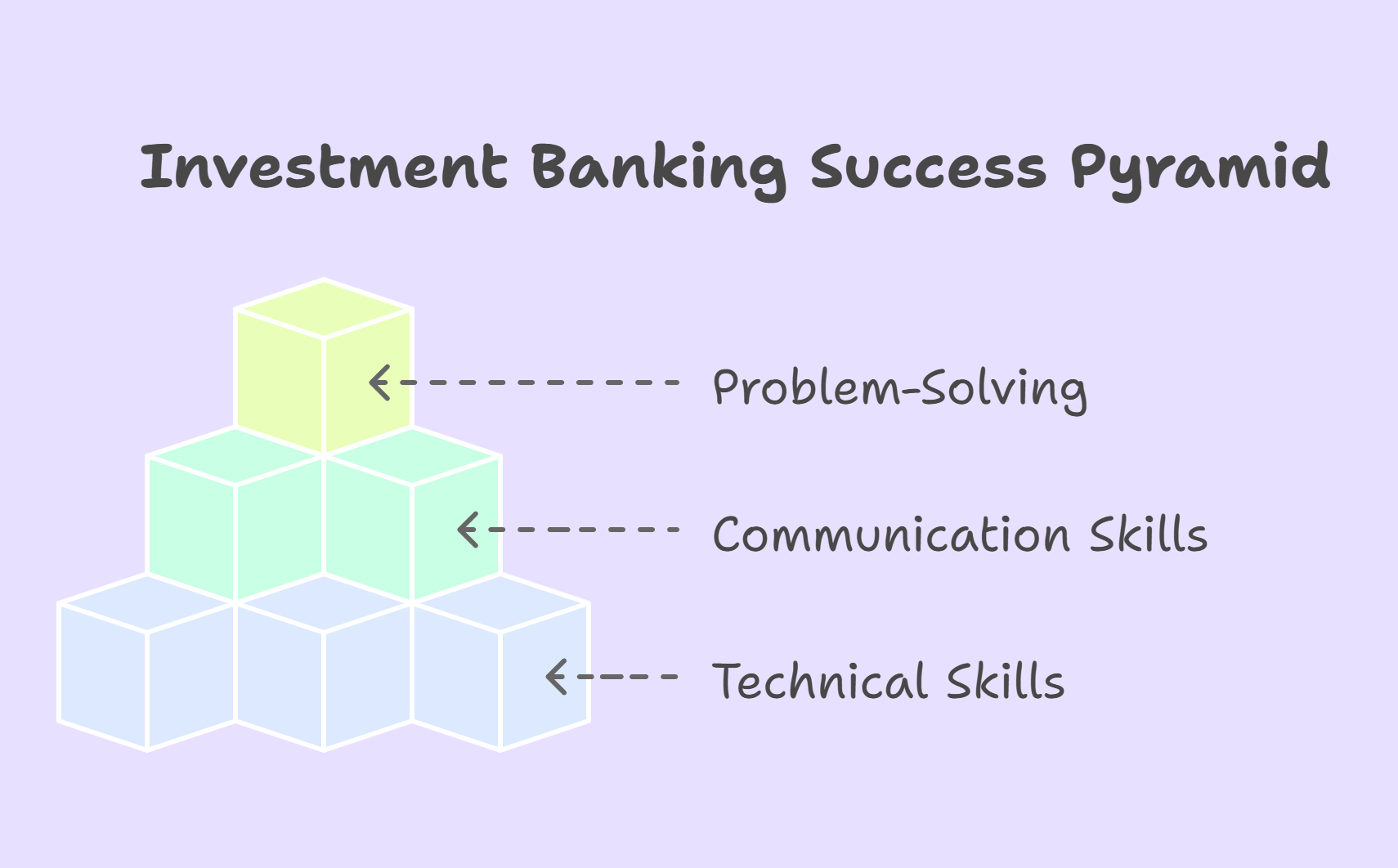

Remember, technical skills are only half the battle. Investment banking is a client-facing role, demanding excellent communication and problem-solving abilities. Practice articulating your thought process clearly and concisely. Explain how you arrive at your answers, demonstrating your logical reasoning and analytical approach.

Imagine explaining a complex valuation methodology to a client who isn't financially savvy. This requires not only a thorough understanding of the concept but also the ability to communicate it effectively. Practice explaining these concepts to friends or family members outside of finance to hone your communication skills.

Conclusion: Your Path to Success

Preparing for investment banking math interviews, whether for an AA or AI role, requires dedicated effort and a strategic approach. By focusing on mental math, mastering core financial concepts, and tailoring your preparation to the specific role, you'll significantly enhance your chances of success. Remember, it's not just about crunching numbers; it's about demonstrating the analytical agility and communication skills that are crucial for thriving in this demanding yet rewarding field.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.