Getting into investment banking isn’t easy, and one thing that can really make a difference is your internal assessment. It’s not just a regular assignment — it’s your opportunity to show that you understand the numbers, can think critically, and have what it takes to succeed in a fast-paced, high-pressure world.

Skip the one-size-fits-all approach. This guide is built on real experience from both hiring managers and candidates. It’ll help you create a strong, standout assessment that gets noticed.

Understanding the Assignment

First, dissect the prompt. What exactly are they asking? Is it a valuation, a deal analysis, or a market overview? Grasping the nuances is crucial.

Internal assessments are designed to test your financial modeling skills, your understanding of valuation methodologies, and your ability to articulate complex ideas concisely. They're also a window into your work ethic and attention to detail.

Building a Solid Foundation: Research and Analysis

Start with rigorous research. Don't just skim surface-level data; delve deep into industry trends, competitive landscapes, and company financials. Use reputable sources like Bloomberg, FactSet, and SEC filings. I've seen candidates fall short by relying solely on readily available internet summaries – a rookie mistake.

Your financial model is the backbone of your assessment. Ensure accuracy and consistency throughout. A single misplaced decimal can derail your entire analysis.

Valuation: More Than Just Numbers

Valuation isn't a plug-and-play exercise. It's about justifying your assumptions. Why did you choose a specific discount rate? What's the rationale behind your growth projections? The "why" behind your numbers is what truly differentiates a strong assessment from a mediocre one.

Consider multiple valuation methods – precedent transactions, discounted cash flow (DCF), and market multiples. Don't just present the results; explain the strengths and weaknesses of each approach in the context of your specific case.

Crafting a Compelling Narrative

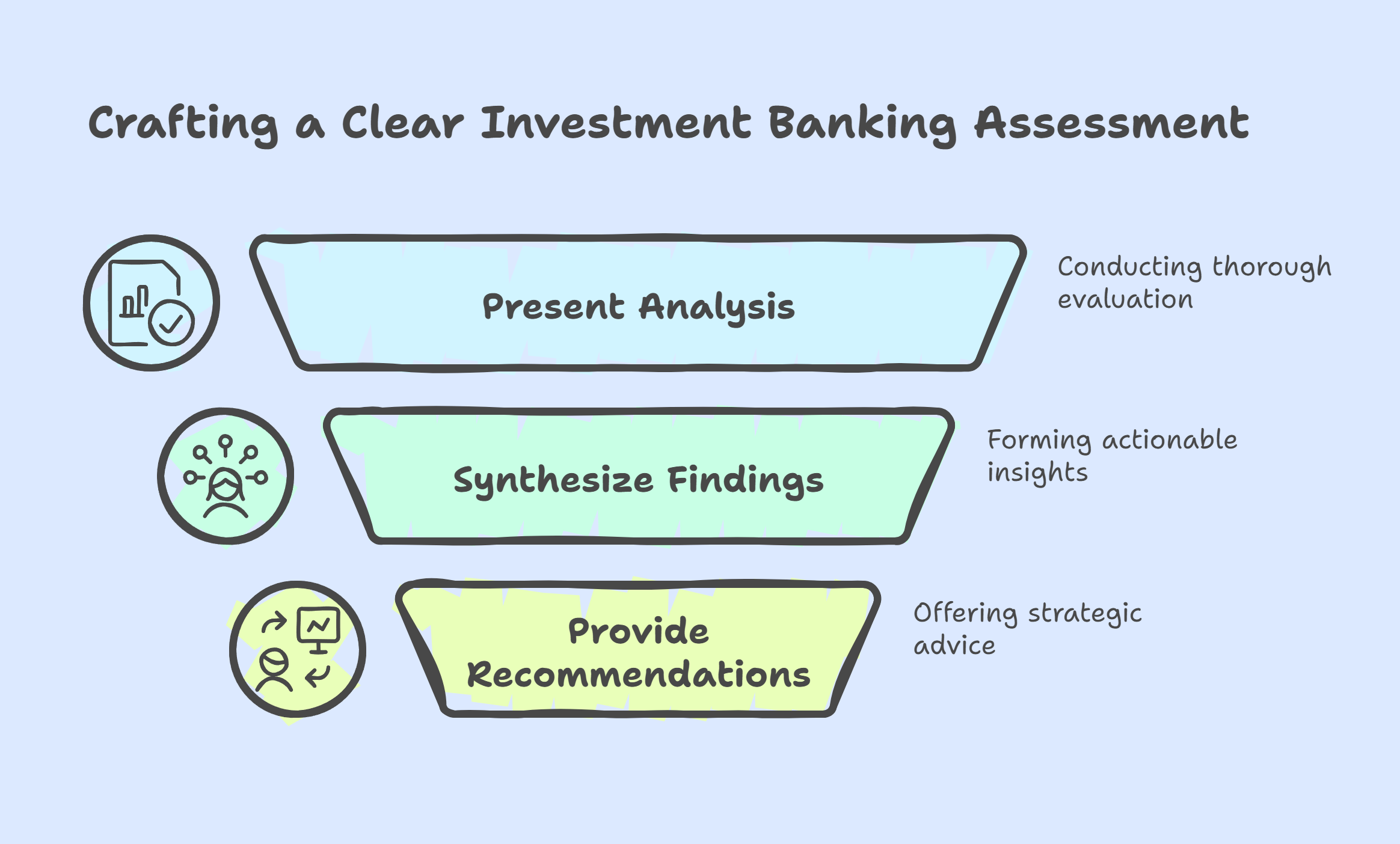

Think of your assessment as a story. It should have a clear beginning, middle, and end. Introduce the company and the industry, present your analysis, and then synthesize your findings into actionable recommendations. Remember, investment banking is about advising clients, so demonstrate your advisory capabilities.

Clarity is key. Use concise language, avoid jargon, and structure your thoughts logically. Busy bankers don't have time to decipher convoluted prose.

The Finishing Touches: Presentation and Proofreading

Presentation matters. A sloppy, error-ridden document sends the wrong message. Use clear headings, consistent formatting, and visually appealing charts and graphs. A well-designed presentation enhances readability and professionalism.

Proofread meticulously. Grammatical errors and typos are unforgivable. Have a fresh pair of eyes review your work before submitting it. It's the equivalent of polishing a diamond – it brings out the brilliance of your hard work.

Example: Comparing Valuation Methods

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mastering the art of the internal assessment requires practice and refinement. Embrace the challenge. View it as an opportunity to showcase your potential and take a significant step towards your investment banking aspirations.

This isn't just about securing an internship or a full-time role; it's about building a foundation for a successful career in finance.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.