Cracking an investment banking interview is no easy task. It’s a tough mix of technical knowledge and the ability to present yourself well.

But here’s something top candidates often use to their advantage: past interview papers. And it’s not just about quickly looking through them — it’s about carefully studying them to understand patterns, common questions, and what interviewers are really looking for. That’s the smart way to prepare and stand out.

Beyond Rote Memorization: Understanding the "Why"

I've seen countless candidates fall into the trap of treating past papers like gospel, memorizing answers without grasping the underlying principles. This is a recipe for disaster.

The real power of past papers lies in understanding the interviewer's intent. What are they truly testing? Is it your knowledge of DCF valuation, or your ability to articulate its nuances under pressure?

Top scorers use past papers to develop a mental framework. They identify recurring themes and build a robust understanding of the core concepts that underpin the questions.

Strategic Practice: Simulating the Real Deal

Imagine stepping into a boxing ring having only shadowboxed. Past papers are your sparring partner, allowing you to practice your technique in a realistic setting.

Don't just passively read through questions and answers. Set a timer, recreate the interview environment, and verbalize your responses. This builds fluency and helps you manage the pressure of thinking on your feet.

Record yourself and critically analyze your performance. Where did you stumble? Did you articulate your thoughts clearly and concisely? This self-assessment is crucial for identifying weaknesses and refining your approach.

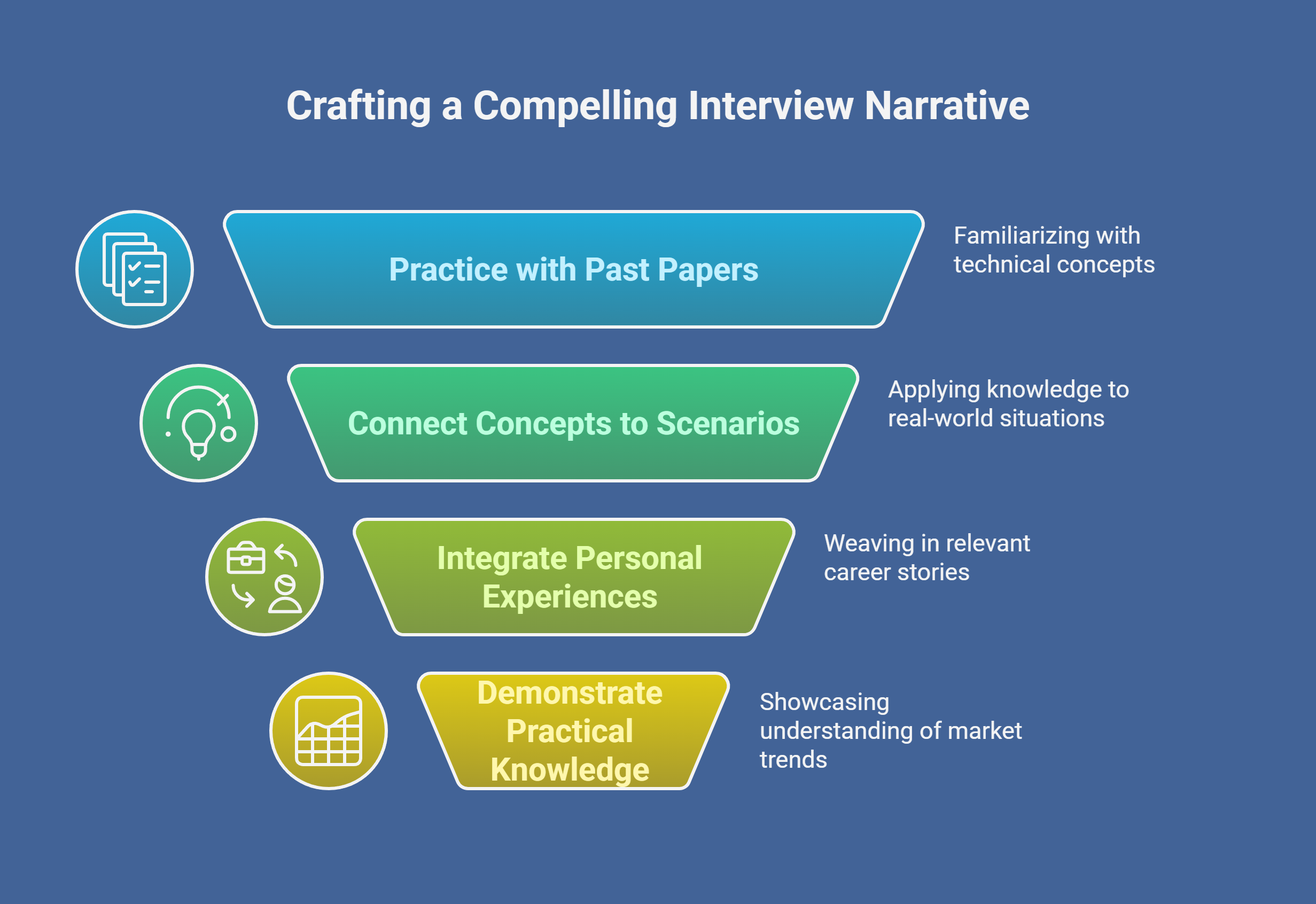

Connecting the Dots: Building a Narrative

Investment banking interviews are not just about reciting formulas. They're about telling a story – your story – and demonstrating how your skills and experiences align with the demands of the role.

Past papers can help you weave this narrative by providing a platform to practice connecting technical concepts to real-world scenarios and your own career aspirations.

For example, when discussing valuation methodologies, don’t just define them. Explain why you might choose one over another in a specific deal context, drawing on examples from your past experiences or showcasing your understanding of current market trends. This demonstrates practical knowledge and insightful thinking – qualities highly valued by recruiters.

Targeted Preparation: Identifying Your Weak Spots

Past papers are an invaluable diagnostic tool. They illuminate your blind spots and highlight areas where you need to focus your preparation.

Are you consistently struggling with questions on LBO modeling? Do you find yourself drawing a blank when asked about specific accounting principles? Identifying these weaknesses allows you to tailor your study plan and maximize your learning efficiency.

Beyond Technical Skills: Mastering the Soft Skills

Technical expertise is only half the battle. Investment banking interviews also assess crucial soft skills like communication, teamwork, and problem-solving.

While past papers may not directly test these skills, they provide a platform to practice structuring your thoughts, articulating your ideas persuasively, and demonstrating your ability to think critically under pressure. These are the very skills that separate good candidates from exceptional ones.

Conclusion: Your Key to Unlocking Success

Past papers are not a shortcut to success, but a powerful tool that, when used strategically, can significantly enhance your preparation. They provide a glimpse into the minds of interviewers, allowing you to anticipate the types of questions you might encounter and develop the skills and knowledge necessary to ace the interview.

So, embrace the challenge, dive into the past papers, and unlock your potential to land that coveted investment banking role.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.