Investment banking has an undeniable appeal — the thrill of high-stakes deals, the rush of sealing complex transactions, and, of course, the attractive paychecks. It’s no wonder so many driven students aim to break into this elite field each year.

However, the journey to Wall Street — or its international counterparts — isn’t an easy one. It requires more than ambition; it demands thoughtful and strategic academic planning.

The subjects you choose during high school and university play a crucial role in shaping your future in investment banking. It's not merely about fulfilling academic requirements; it’s about laying a strong foundation in finance and economics while clearly demonstrating your genuine interest to future employers.

Essential High School Subjects: Building the Foundation

A strong high school record is the first stepping stone. Focus on these crucial subjects:

- Mathematics: Calculus, statistics, and algebra are indispensable. Investment banking is intrinsically quantitative; a firm grasp of these concepts is non-negotiable.

- Economics: Understanding micro and macroeconomics lays the groundwork for analyzing market trends and investment strategies. Look for opportunities to participate in economics clubs or competitions.

- Business Studies/Accounting: Get a head start on understanding financial statements, business structures, and market dynamics. This knowledge can be invaluable for university applications and internships.

Beyond academics, extracurriculars like debate club or Model UN can hone your communication and negotiation skills – vital assets in the investment banking world.

University Subject Choices: Shaping Your Expertise

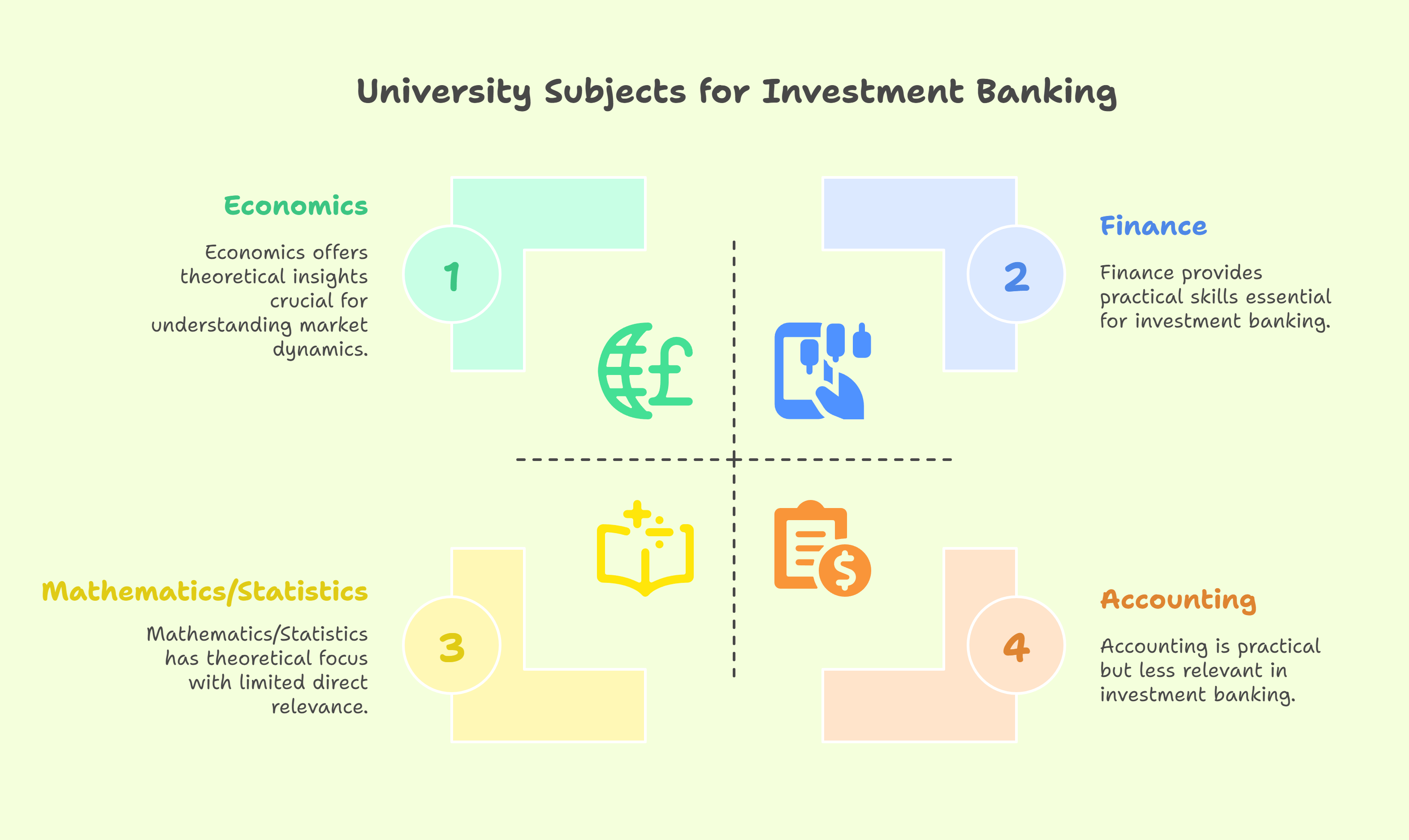

The real game-changer is your university degree. While a specific "Investment Banking" major isn't always necessary, choosing the right subjects within your chosen field is critical. Consider these popular and effective options:

- Finance: A no-brainer. Deep dive into corporate finance, valuation, financial modeling, and portfolio management. Seek out universities with strong finance departments and industry connections.

- Economics: Continuing your economic studies at the university level provides a broader perspective on market forces, policy implications, and global financial systems. Econometrics – the application of statistical methods to economic data – is particularly relevant.

- Accounting: Developing strong accounting skills provides a crucial understanding of financial reporting, auditing, and tax implications – all essential for analyzing company performance and structuring deals.

- Mathematics/Statistics: A quantitative background opens doors to roles requiring complex financial modeling, risk management, and algorithmic trading.

Remember, diversity adds flavor. Consider supplementing your core finance subjects with courses in computer science (for programming and data analysis) or even psychology (to understand investor behavior).

Gaining the Edge: Beyond the Classroom

Landing a coveted investment banking internship is often the golden ticket. Maximize your chances by:

- Networking: Attend industry events, connect with professionals on LinkedIn, and leverage your university's alumni network. Personal connections can make all the difference.

- Building Financial Modeling Skills: Become proficient in Excel and learn financial modeling techniques. Numerous online resources and courses can help you master this essential skill.

- Staying Updated: Follow financial news, read industry publications (like the Wall Street Journal and Financial Times), and understand current market trends.

Conclusion: Charting Your Course

Breaking into investment banking requires a strategic blend of academic prowess, practical skills, and relentless networking. By carefully selecting your subjects, engaging actively in extracurricular activities, and demonstrating a genuine passion for finance, you can position yourself for success in this demanding but highly rewarding field. The thrill of the deal awaits those willing to put in the work.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.