Think of it like renovating a house using a loan—that's essentially what a Leveraged Buyout (LBO) is, but on a corporate scale. It’s a bold financial strategy that involves acquiring a company primarily with borrowed funds. While it may sound complex, at its heart, an LBO is a strategic mix of debt, investor capital, and carefully measured risk—all aimed at transforming a business and generating strong returns.

What is an LBO?

An LBO involves acquiring a company using a significant amount of borrowed capital (the "leverage"). Private equity firms are the typical orchestrators of these deals, spotting undervalued companies or those ripe for restructuring. They raise debt – often from banks and bond investors – to fund the purchase, using the acquired company's assets as collateral. This high debt-to-equity ratio amplifies potential returns, but it also magnifies the risk.

Think of it as using a small amount of your own money and a large loan to buy a rental property. The rental income covers the loan repayments, and you profit from any appreciation in property value. In an LBO, the target company's cash flow services the debt, and the private equity firm aims to increase the company's value before eventually selling it.

Why pursue an LBO?

Several factors drive private equity firms towards LBOs. The allure of high returns is undeniable. By leveraging borrowed capital, they can significantly multiply their gains compared to using only their own equity. Furthermore, LBOs provide an opportunity to reshape businesses, improve operational efficiency, and unlock hidden value. Sometimes, a company just needs a fresh perspective and strategic direction, which a private equity firm can provide.

- Amplified Returns: The magic of leverage multiplies profits.

- Restructuring Opportunities: Streamlining and optimizing operations.

- Undervalued Targets: Finding diamonds in the rough.

How does an LBO work?

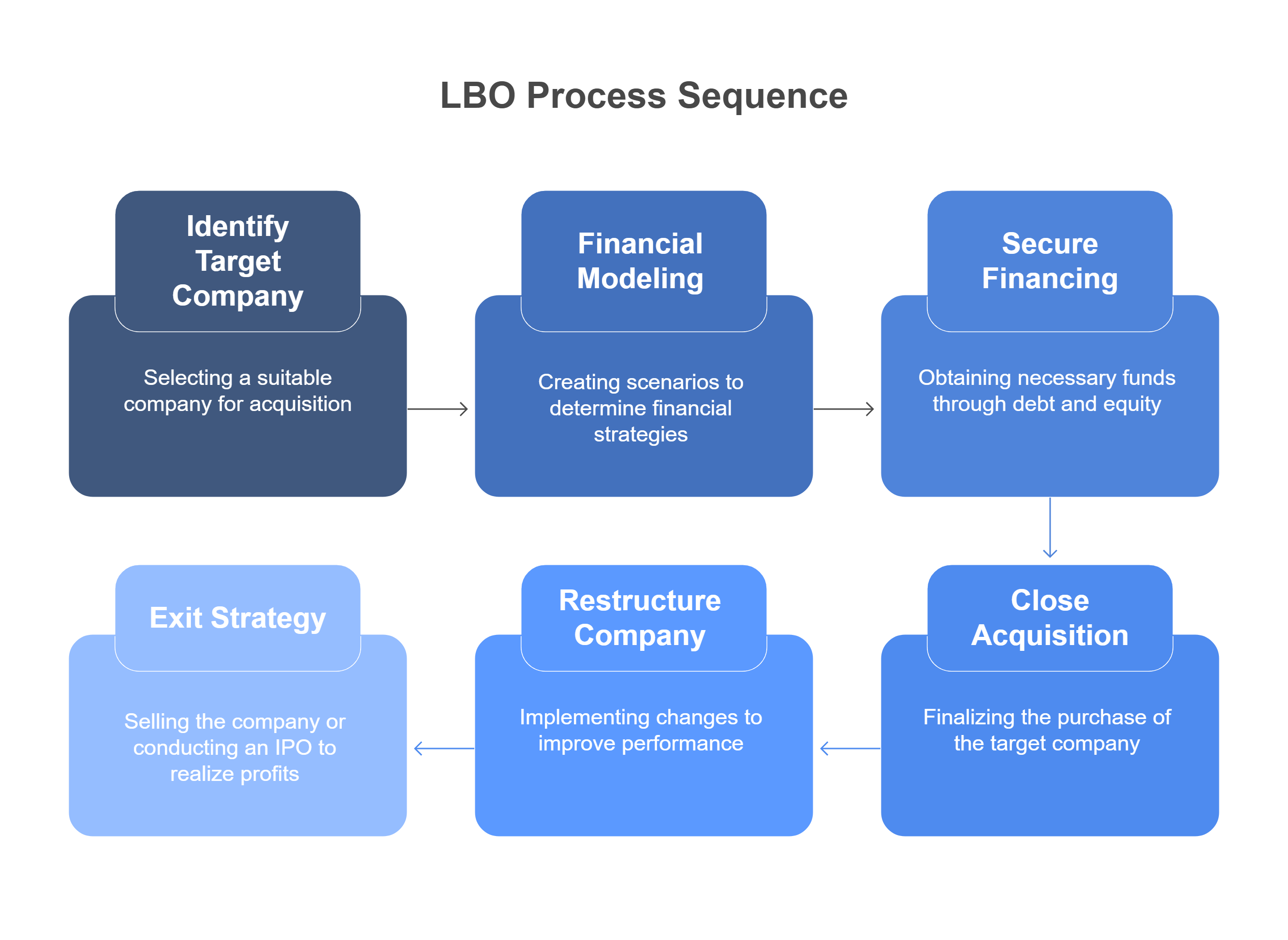

The LBO process is a complex dance involving financial modeling, due diligence, and negotiation. It starts with identifying a suitable target company. Then comes the meticulous financial modeling, the heart of the LBO, where the private equity firm crafts various scenarios to determine the optimal debt-to-equity ratio, projected cash flows, and potential returns. This model acts as a roadmap for the entire transaction.

Next comes securing financing, typically a mix of senior debt, mezzanine debt, and equity. Once financing is in place, the acquisition closes, and the restructuring begins. The private equity firm works intensely with the management team to implement changes, improve performance, and ultimately, boost the company's value. The final act is the exit strategy, typically an IPO or sale to another company, where the private equity firm realizes its profits.

Example: The RJR Nabisco LBO

The 1988 leveraged buyout of RJR Nabisco, chronicled in the book and movie "Barbarians at the Gate," serves as a cautionary yet fascinating example. This highly publicized LBO, involving a bidding war and ultimately costing over $25 billion, highlighted the potential scale and drama inherent in these transactions. While demonstrating the potential for massive returns, it also underscored the risks of over-leveraging and aggressive bidding.

Conclusion

LBOs are a powerful tool for financial engineering, offering the potential for high returns while also carrying significant risk. They’re not just about numbers on a spreadsheet; they’re about transforming companies, creating value, and reshaping industries. Understanding the "what, why, and how" of LBOs provides valuable insight into the dynamics of the financial world and the constant pursuit of maximizing value.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.