Investment banking might seem all glamorous on the outside — fancy offices, big deals, and luxury lifestyles. But the reality is very different. It’s a tough field that demands a special mix of skills, hard work, and the right knowledge.

Many students dive deep into their studies, hoping to figure out what it really takes to succeed. But the truth is, some subjects are far more useful than others — even if no one talks about them openly.

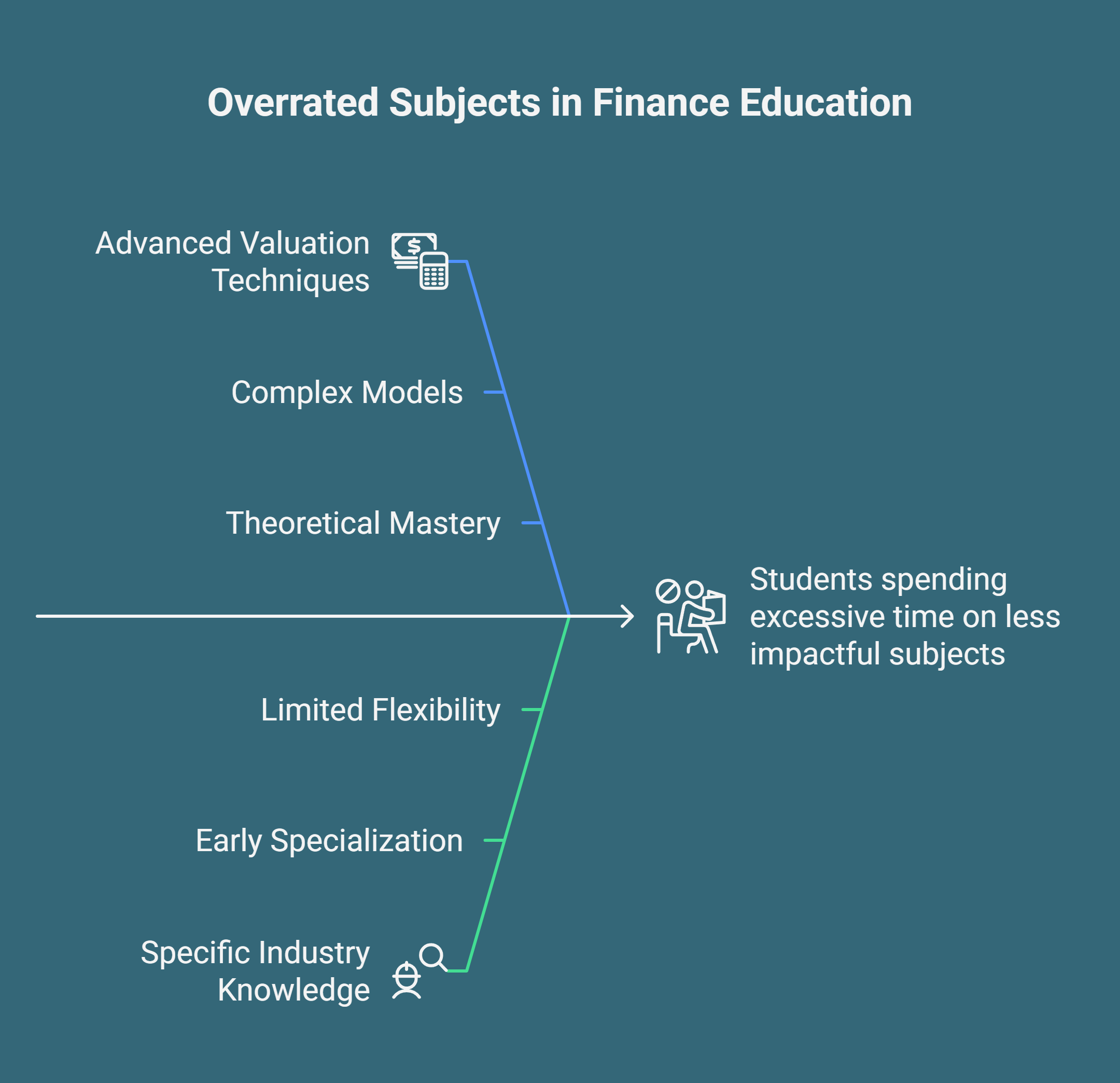

The Overrated: Where Students Spend Too Much Time

Let's face it, some subjects get more hype than they deserve. Students often find themselves bogged down in minutiae, missing the bigger picture.

Advanced Valuation Techniques: While a solid understanding of valuation is crucial, obsessing over complex models often yields diminishing returns. Practical experience trumps theoretical mastery in this field.

One former analyst at a bulge bracket firm confided, "I spent weeks perfecting a discounted cash flow model, only to realize senior bankers rely more on intuition and market comparables."

Specific Industry Knowledge: Focusing too early on one specific industry can limit career flexibility. Foundational financial skills are transferable, while niche expertise can be developed later.

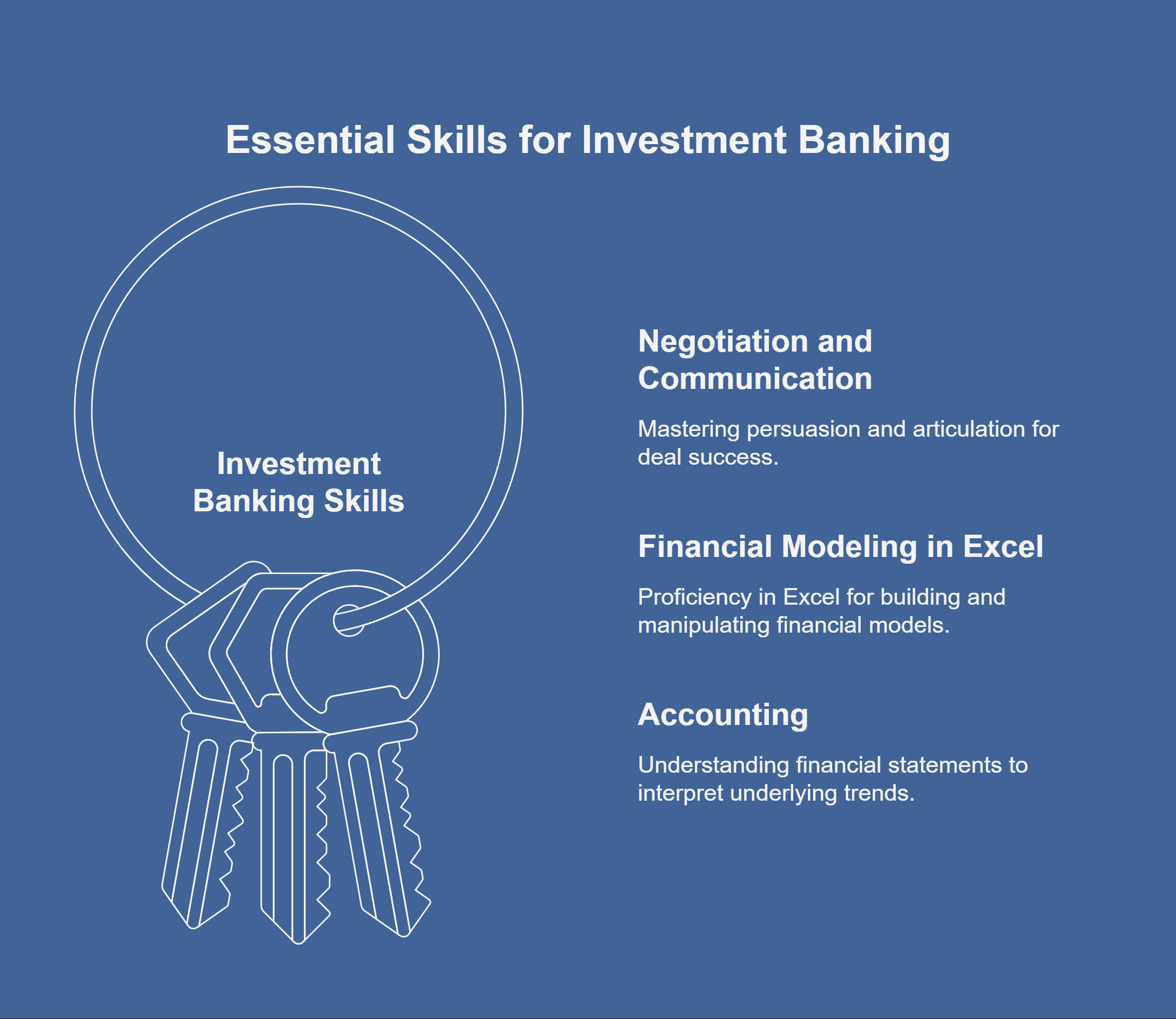

The Underrated: Hidden Gems of Investment Banking

These are the subjects that often fly under the radar, yet pack a powerful punch in the real world of investment banking.

Negotiation and Communication Skills: Deals are won and lost based on the ability to persuade. Mastering these soft skills is paramount, yet often neglected in formal education. A sharp mind is useless without the ability to articulate your thoughts effectively.

Think about it. Can you confidently present to a room full of skeptical investors? Can you navigate a tense negotiation with grace and poise?

Financial Modeling in Excel: Forget complex software. Excel remains the workhorse of the industry. A deep understanding of its functionalities is essential for building and manipulating financial models efficiently.

Hours spent wrestling with spreadsheets might seem mundane, but they build a crucial foundation for success. “My Excel skills were constantly tested,” a junior banker told me. “Being able to build a robust model quickly is invaluable.”

Accounting: Grasping the nuances of financial statements is non-negotiable. Understanding how companies record and report their financials allows analysts to dissect the story behind the numbers.

It's not just about crunching numbers, it's about interpreting them. What are the underlying trends? What are the potential red flags? This is where the true value lies.

What Students Wish They Knew

- Prioritize practical skills over theoretical knowledge.

- Network relentlessly and build relationships with industry professionals.

- Focus on developing strong communication and presentation skills.

- Master Excel and become proficient in financial modeling.

The Takeaway

The path to investment banking success isn't paved with perfect grades in esoteric subjects. It's about developing a robust skillset that combines technical proficiency with interpersonal finesse.

Focus on building a strong foundation in the underrated subjects. Hone your communication skills. Master the art of negotiation. Become an Excel wizard. These are the keys to unlocking your potential in the competitive world of investment banking.

So, as you navigate the maze of coursework, remember this: practical experience and strong soft skills are your secret weapons. Don't let the allure of the overrated distract you from the true path to success.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.