Ever dreamed of sealing million-dollar deals and being part of the thrilling, high-stakes world of finance?

A career in investment banking can be incredibly rewarding—but it’s no cakewalk. Behind the fancy job title lies a world of long hours, tough calls, and serious hustle. In this article, we dive into the real-life journeys of successful investment bankers—their challenges, their wins, and what it truly takes to make it in this fast-moving field.

Breaking In: More Than Just a Stellar Resume

Landing that coveted first job is often the hardest part. A strong academic background from prestigious universities like Harvard or Wharton can give you a leg up, but it’s not the only key. Networking, internships, and demonstrating a genuine passion for finance are crucial. I remember attending countless networking events, feeling like a small fish in a very large pond. The key takeaway? Authenticity matters. Recruiters can spot genuine enthusiasm a mile away.

One former analyst at Goldman Sachs, Sarah Chen, shared her experience, "My internship experience at a boutique investment bank was invaluable. It gave me the practical skills and exposure I needed to stand out from the crowd during the grueling interview process."

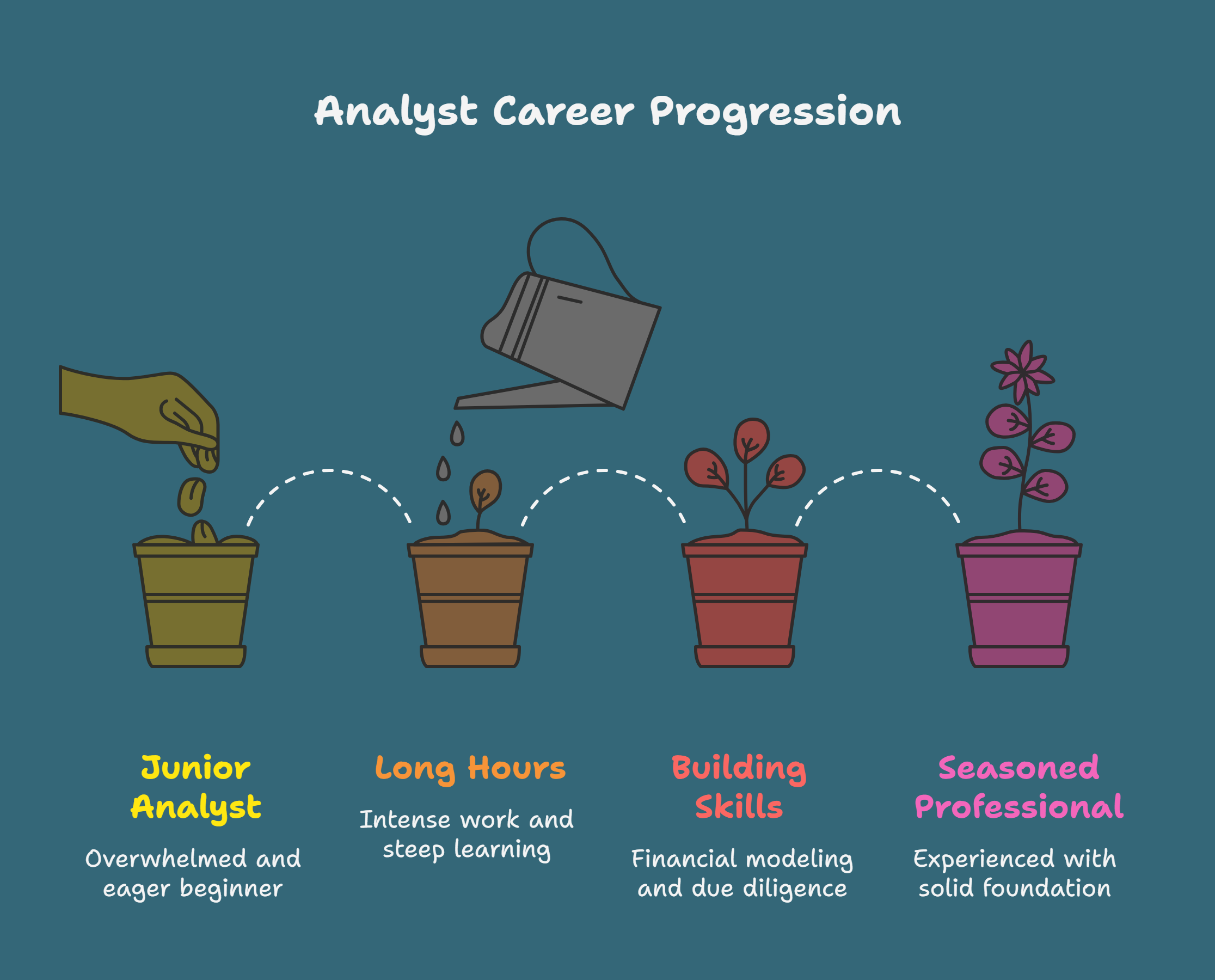

Navigating the Analyst Years: Trial by Fire

The initial years as an analyst are notoriously demanding. Long hours, intense pressure, and a steep learning curve are the norm. Think 80-100 hour work weeks fueled by caffeine and the desire to prove yourself. Building financial models, conducting due diligence, and preparing pitch books become your bread and butter. Resilience is key during this period.

The rewards, however, can be substantial. The experience gained during these formative years builds a solid foundation for future career progression. One former analyst, now a Managing Director at a leading investment bank, recalls, "Those early years were tough, no doubt. But they instilled in me a work ethic and attention to detail that have served me well throughout my career."

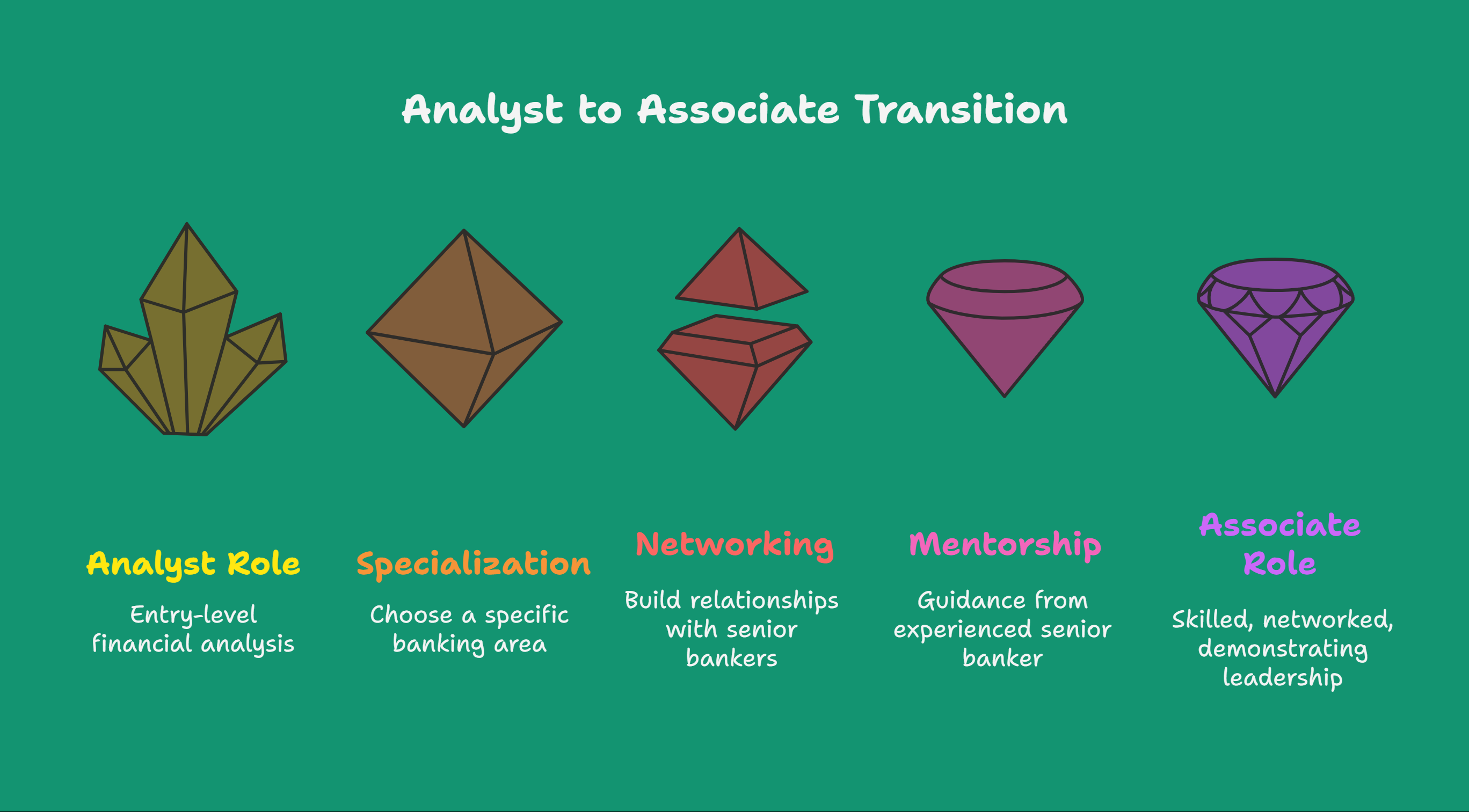

The Path to Associate and Beyond: Specialization and Strategy

After two to three years as an analyst, many transition to the Associate role. This often involves choosing a specialization, such as Mergers & Acquisitions (M&A), Leveraged Buyouts (LBO), or Equity Capital Markets. Strategic networking and building relationships with senior bankers become even more critical. This phase is about honing your skills, expanding your network, and demonstrating leadership potential.

Mentorship plays a vital role during this transition. Finding a senior banker who can guide you and provide insights into the industry can be invaluable. "My mentor helped me navigate the complexities of the industry and understand the unspoken rules of the game," shared a successful Vice President in M&A.

The Long Game: Building a Sustainable Career

A successful investment banking career is a marathon, not a sprint. It requires sustained effort, continuous learning, and adaptability. The financial landscape is constantly evolving, requiring professionals to stay updated with the latest trends and regulations. Work-life balance also becomes a crucial consideration, especially for those looking to build a long-term career in the industry.

While the financial rewards can be significant, the true measure of success often lies in the impact you make. "The most rewarding aspect of my career has been the opportunity to advise companies on transformative deals that have shaped industries," reflected a seasoned Managing Director.

Conclusion:

A career in investment banking isn't for the faint of heart. It demands dedication, resilience, and a sharp mind. However, for those willing to put in the effort, the rewards can be substantial, both financially and professionally. The stories shared here highlight the importance of perseverance, strategic networking, and a genuine passion for finance. So, if you're ready for the challenge, the world of investment banking awaits.