When you think of Wall Street, you probably picture power, wealth, and tradition, right?

But here’s the thing – things are changing big time. Blockchain and cryptocurrency? They’re not just trendy terms anymore. They’re actually shaking up the whole investment banking world, pushing old-school institutions to either keep up or risk falling behind.

Reshaping the Financial Landscape

Remember the days of endless paperwork, opaque processes, and agonizingly slow transactions? Blockchain technology, the backbone of cryptocurrencies like Bitcoin, promises to sweep all that away. By creating a secure, transparent, and immutable ledger of transactions, blockchain streamlines everything from settlements to compliance.

This isn’t just theoretical. Major players like J.P. Morgan are already utilizing blockchain for cross-border payments, drastically reducing settlement times and costs. Imagine a world where transferring millions across continents takes minutes, not days. That’s the power of blockchain.

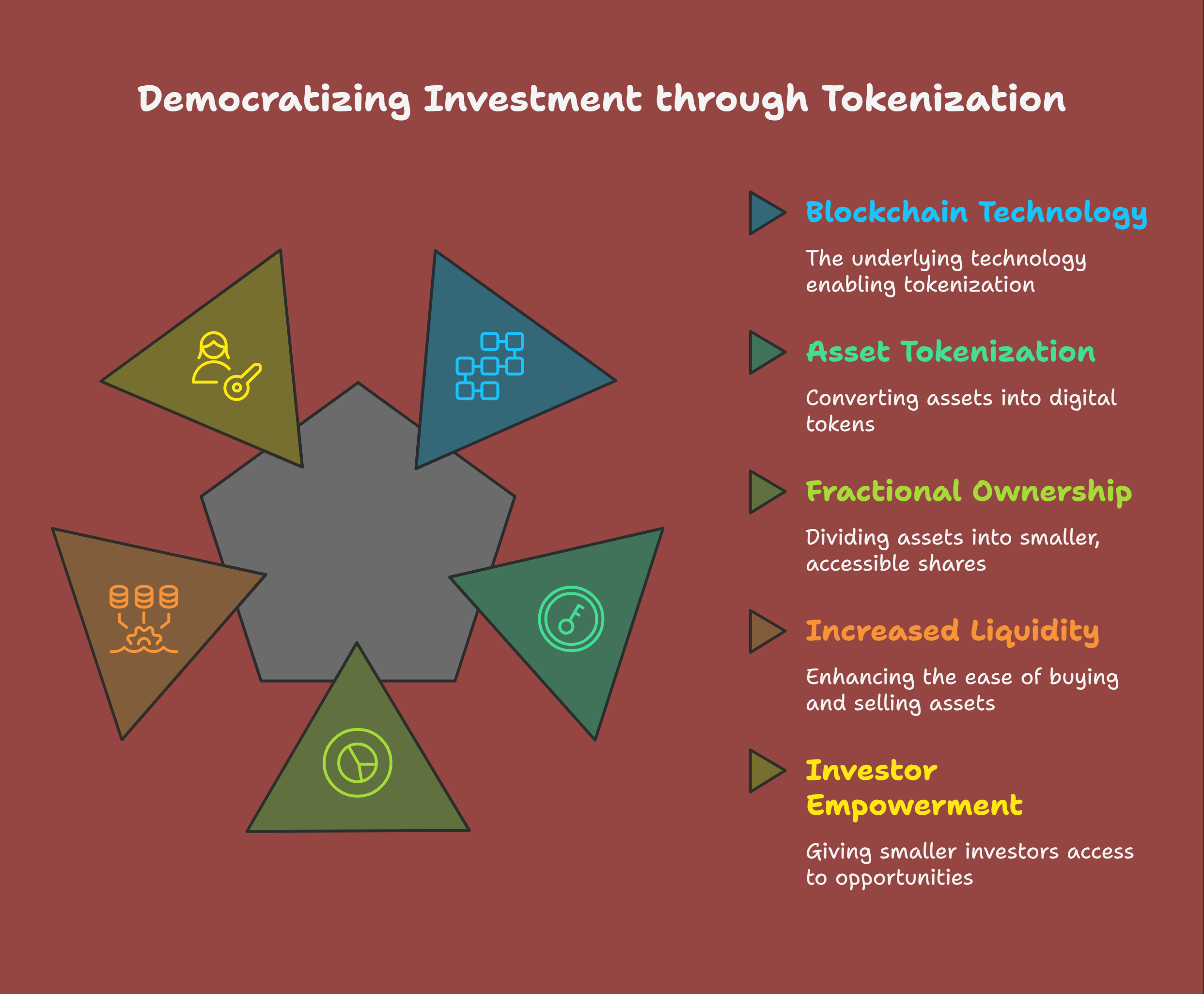

Tokenization: Democratizing Investment

Beyond cryptocurrencies themselves, blockchain facilitates the tokenization of assets. Think real estate, fine art, even private company equity. These assets can be fractionalized and represented as digital tokens, opening up investment opportunities to a wider audience. Suddenly, owning a piece of a Picasso becomes a possibility for everyday investors, not just the ultra-rich.

This democratization of investment is a game-changer. It not only unlocks liquidity in previously illiquid markets but also empowers smaller investors. I’ve seen firsthand the excitement surrounding tokenized assets, and I believe this is just the beginning of a massive wave of innovation.

Navigating the Regulatory Labyrinth

Of course, this brave new world isn't without its challenges. The regulatory landscape surrounding crypto and blockchain is constantly evolving, creating uncertainty for investment banks. Governments worldwide are grappling with how to classify and regulate these digital assets, creating a complex web of rules and regulations that financial institutions must navigate.

The Securities and Exchange Commission (SEC) in the US, for example, is actively scrutinizing the crypto space. Their decisions will have far-reaching consequences, shaping the future of digital asset adoption within the investment banking sector.

The Future of Finance: A Symbiotic Relationship

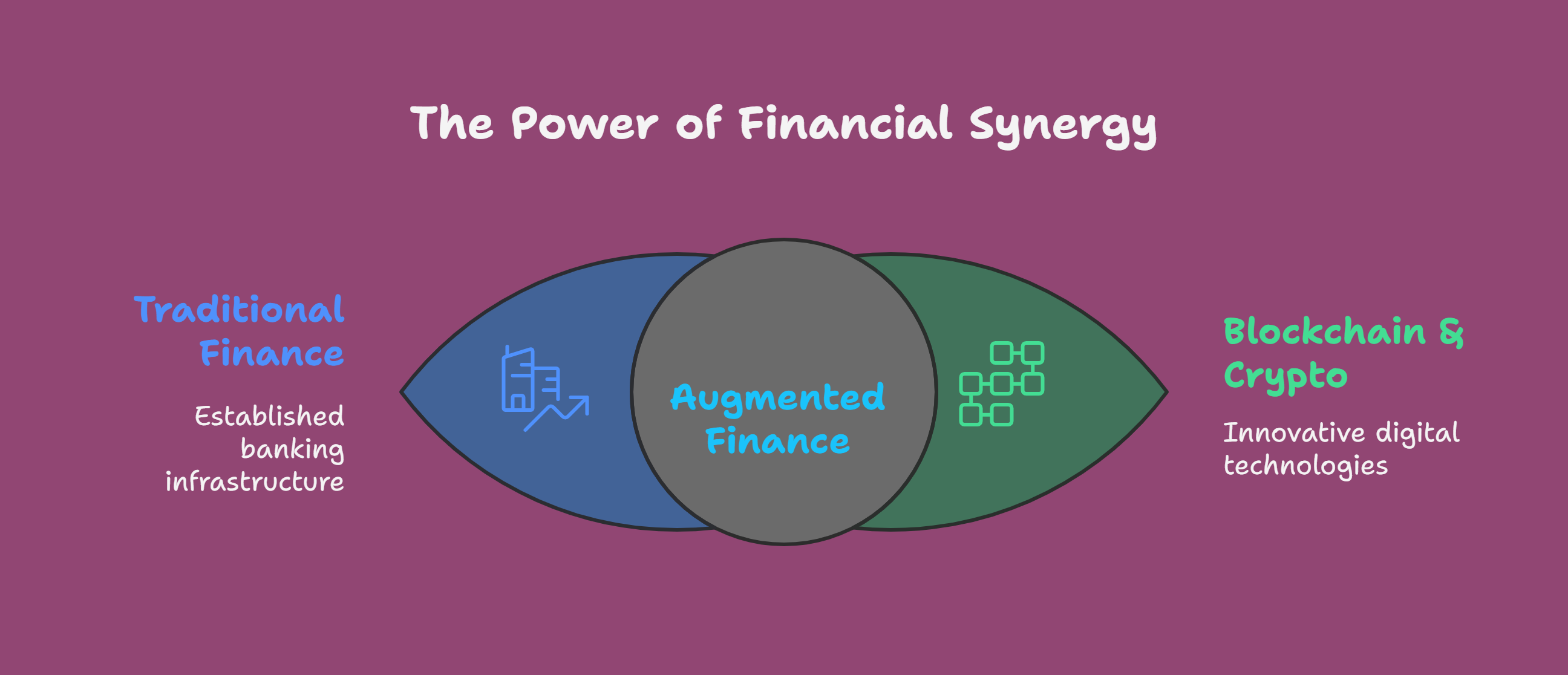

Despite the regulatory hurdles, the potential of blockchain and crypto is undeniable. Investment banks are recognizing this, exploring ways to integrate these technologies into their existing infrastructure.

We're seeing the rise of specialized crypto trading desks, the development of new financial products based on digital assets, and even the creation of entirely new business models centered around blockchain.

It’s not about replacing traditional finance; it's about augmenting it. Imagine a future where blockchain enhances efficiency, transparency, and accessibility within investment banking. That future isn't some distant fantasy; it's being built right now.

Crypto and Blockchain: A Transformative Force

- Enhanced Efficiency: Streamlined processes, reduced settlement times.

- Increased Transparency: Immutable records, reduced fraud potential.

- Greater Accessibility: Democratized investment opportunities.

Conclusion: Embracing the Inevitable

The convergence of blockchain, crypto, and investment banking is not just a trend; it’s a transformation. The institutions that embrace this change, those willing to experiment and innovate, will be the ones who thrive in the new financial landscape. The future of finance is here, and it’s decentralized, digital, and disruptive.