The mergers and acquisitions (M&A) scene is ever-evolving—a fast-paced interplay between industry titans and emerging challengers. And 2025 is proving to follow that same rhythm, with certain sectors standing out as especially active. No need for predictions from a crystal ball—the signs are already pointing toward big moves. Here’s my perspective on the five industries poised for the most significant M&A activity this year.

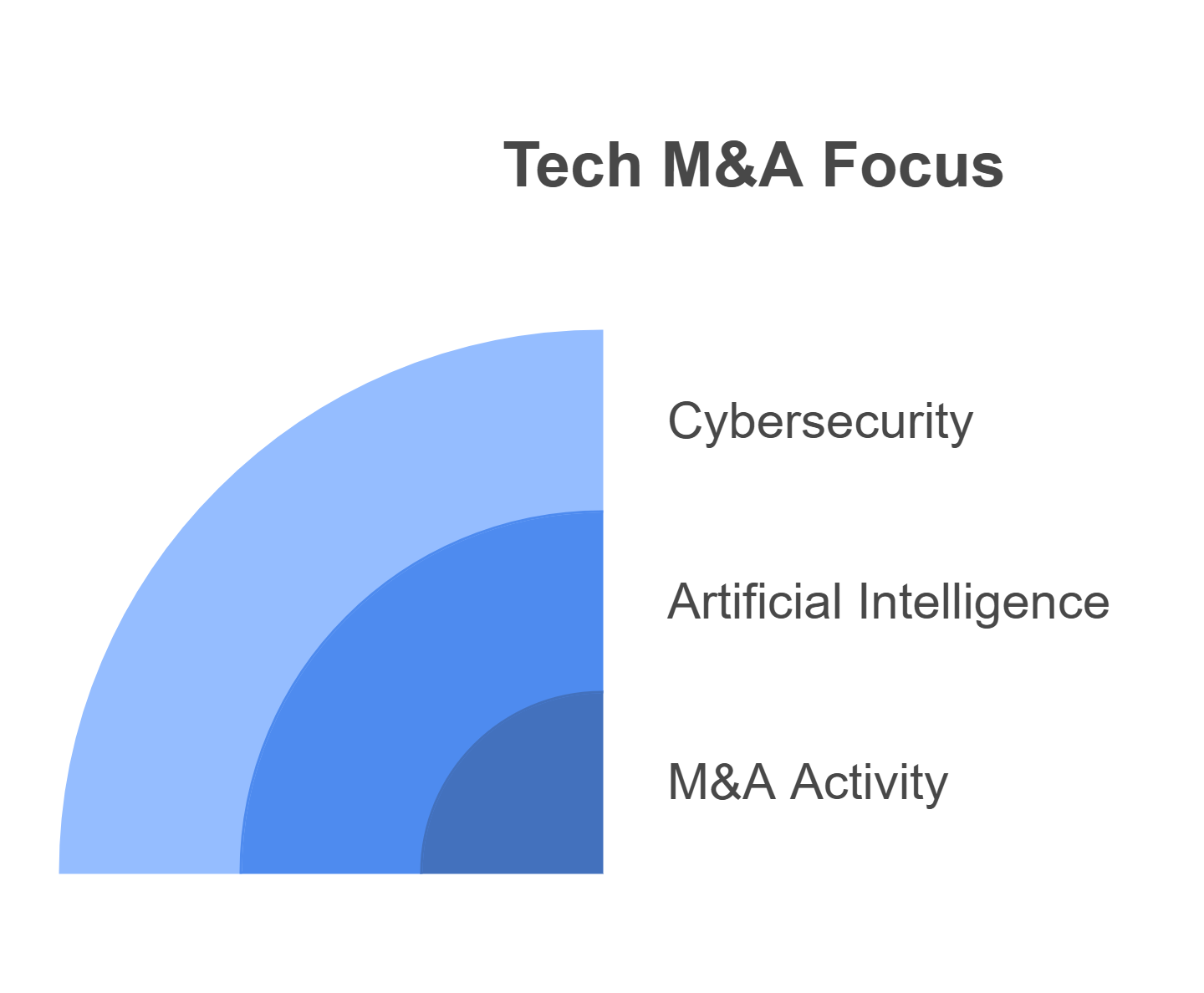

1. Technology: The Everlasting Gold Rush

Tech continues its reign as the king of M&A. The insatiable hunger for innovation fuels a constant churn of buyouts and mergers. This year, I expect a particular focus on Artificial Intelligence, particularly generative AI companies. Think smaller players getting snapped up by the established behemoths. We’ve already seen glimpses of this trend, and it's only going to accelerate. Cybersecurity is another hotbed, with companies scrambling to bolster their defenses in an increasingly perilous digital world.

2. Healthcare: A Prescription for Consolidation

The healthcare sector is undergoing a dramatic transformation. The pandemic exposed vulnerabilities and accelerated existing trends. Expect to see a wave of mergers and acquisitions in the telehealth space, as providers scramble to meet the demand for remote care. Biotech is another area ripe for consolidation, with larger pharmaceutical companies looking to acquire innovative startups developing groundbreaking therapies. The pressure to control costs and improve efficiency will also drive M&A activity among hospitals and healthcare systems.

.png)

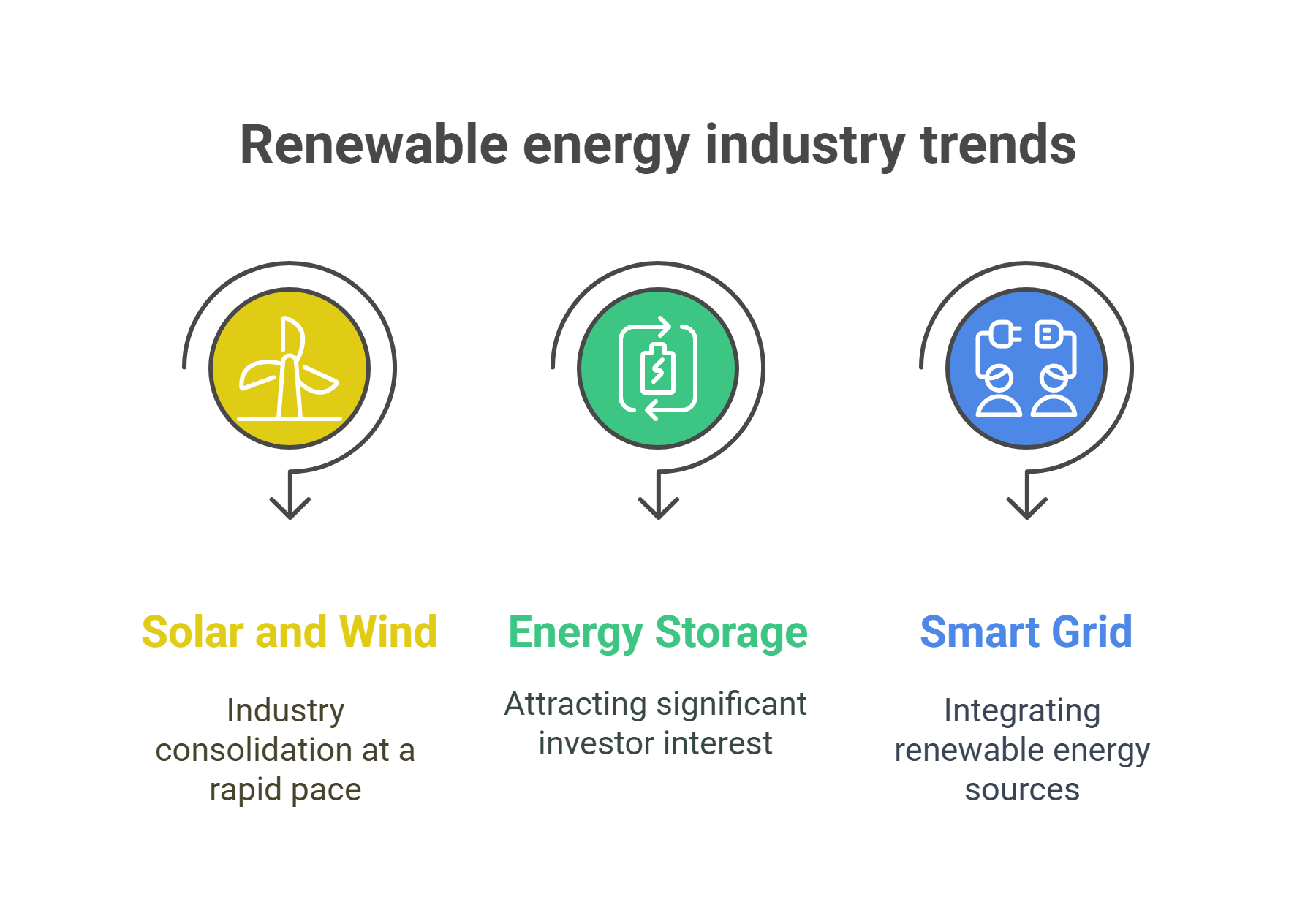

3. Renewable Energy: Powering the Future of Deals

As the world pivots toward sustainable energy, investment in renewables is skyrocketing. This creates fertile ground for M&A activity, as companies seek to gain scale and expand their reach. Solar and wind energy companies are particularly attractive targets. Expect to see large energy companies acquiring smaller, innovative players in these fields, as well as mergers between existing renewable energy firms. The race is on to dominate this burgeoning market.

- Solar and wind energy: Consolidation continues at a rapid pace.

- Energy storage technologies: A key area attracting investor interest.

- Smart grid infrastructure: Facilitating the integration of renewables.

4. Financial Services: Fintech Fuels the Fire

The financial services industry is being revolutionized by technology. Fintech startups are disrupting traditional banking, payments, and investment management. This disruption is driving a surge in M&A, as established financial institutions seek to acquire the technology and talent they need to compete. Expect to see more deals involving payment processing companies, digital lending platforms, and robo-advisors.

For example, a recent report by McKinsey highlighted that digital payments accounted for over $8 trillion globally in 2024. This staggering figure underscores the immense potential of fintech and its attractiveness for M&A.

5. E-commerce: The Never-Ending Story

The pandemic supercharged the growth of e-commerce, and the trend shows no signs of slowing down. Competition in this space is fierce, with companies constantly seeking ways to gain an edge. M&A activity is a key strategy for expansion and market share consolidation. Expect to see both horizontal mergers (between competing e-commerce companies) and vertical mergers (between e-commerce companies and companies in related industries, such as logistics or marketing).

Conclusion: A Dynamic Year Ahead

2025 promises to be a thrilling year for mergers and acquisitions. The forces driving these deals are complex and interconnected – technological innovation, changing consumer preferences, regulatory pressures, and the ever-present pursuit of growth and profitability. The sectors highlighted here are at the forefront of this transformation, offering a glimpse into the future of business. Keep your eyes peeled, because the landscape can shift in an instant. This is just the beginning of the story.