Ever dreamt of owning a slice of a big company? Initial Public Offerings, or IPOs, let you do just that. They're a company's grand entrance onto the stock market.

Think of it like a shop opening its doors for the first time, offering shares to the public.

India's IPO market is buzzing, and 2025 looks promising. Let's explore the hottest sectors expected to sizzle.

Exploring a career in Investment Banking? Apply now!

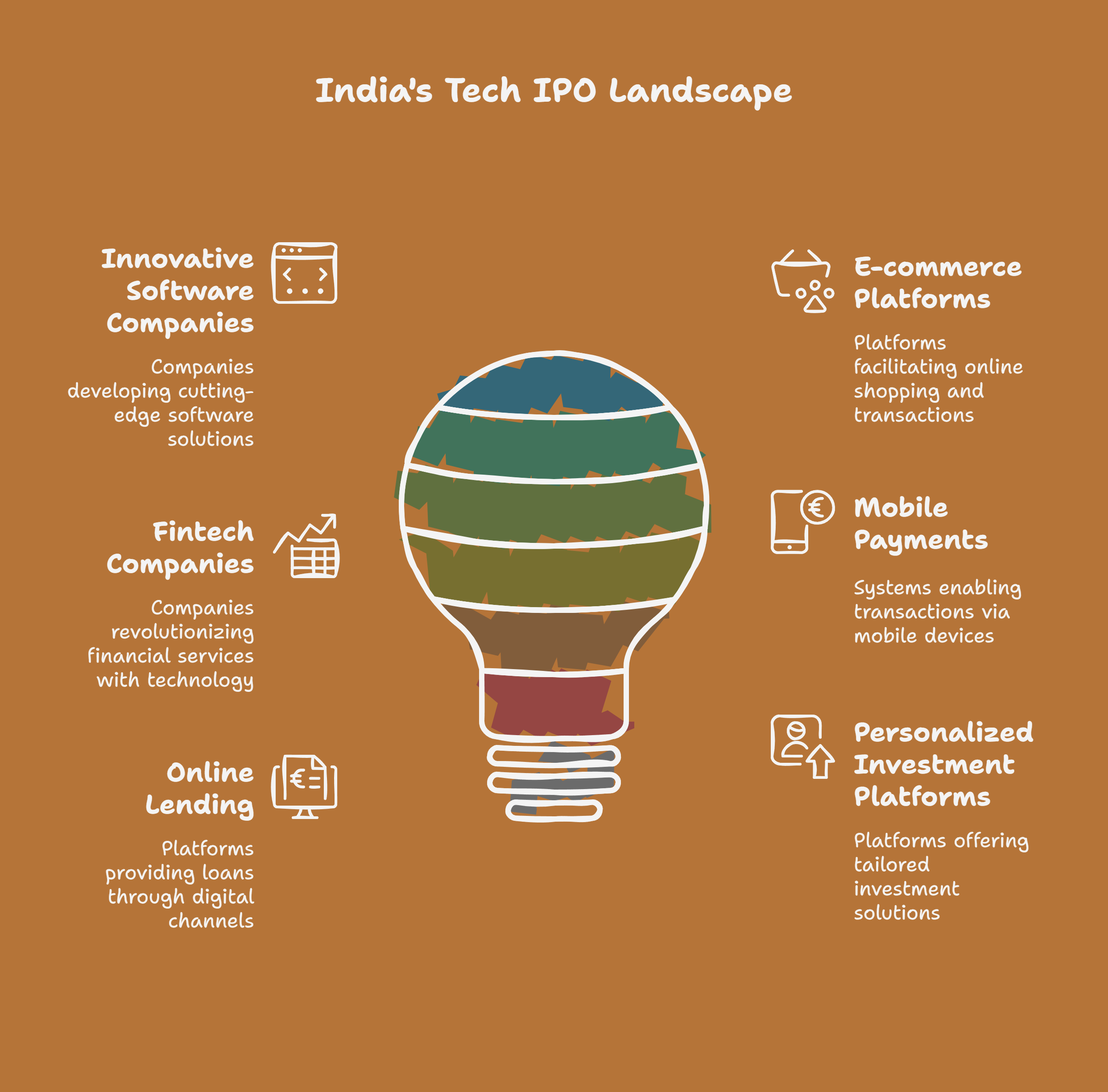

Tech Titans Taking the Stage

Technology continues its reign. The digital revolution in India shows no signs of slowing, fueling a surge of tech IPOs.

From innovative software companies to exciting e-commerce platforms, expect a diverse range of tech ventures seeking funding.

Keep an eye on fintech companies, especially. These tech-savvy financial disruptors are changing how we manage money.

They are attracting huge investor interest. Think mobile payments, online lending, and personalized investment platforms – all ripe for IPOs.

Healthcare Heats Up

The healthcare sector is experiencing tremendous growth, accelerated by increased health awareness and advancements in medical technology.

Expect a wave of IPOs from pharmaceutical companies developing life-saving drugs.

Healthtech companies are another area to watch, bringing innovative solutions to healthcare delivery.

Telemedicine platforms, diagnostic tools, and personalized health monitoring are just a few examples. Investing in healthcare IPOs can be a way to support innovation and potentially reap financial rewards.

Renewable Energy: Powering the Future

With the growing focus on sustainability, the renewable energy sector is shining bright. India is pushing for cleaner energy sources.

This makes it a prime location for companies developing solar, wind, and other renewable energy technologies.

Expect to see a rise in renewable energy IPOs, offering opportunities to invest in a greener future.

This is a chance to be part of a global shift towards sustainable energy solutions.

.png)

Consumer-Centric Companies: Catering to the Masses

India's booming consumer market attracts companies offering a wide array of products and services. Everything from fashion and food to entertainment and travel.

These companies are often well-positioned for successful IPOs.

Look out for unique brands creating a buzz. Innovative companies catering to evolving consumer preferences are likely to capture investor attention.

Examples might include direct-to-consumer brands, online retailers, and entertainment platforms.

While 2025 holds exciting prospects, remember that investing in IPOs carries risks. Do your homework, research the companies carefully, and consult with a financial advisor before making any investment decisions.

Dreaming of a finance career? Start with Investment Banking Certification with Jobaaj Learnings.