Ever wonder what a CFA charterholder actually does? It’s more than just a fancy set of letters on a business card. Earning the CFA charter is like getting a passport into the high-stakes, fast-moving world of finance — one that opens doors to some of the most exciting (and well-paying) roles in the industry.

But what does it really mean to have those three letters behind your name? What kinds of jobs can it lead to? And yes — let’s talk money: what kind of salary can you expect?

Whether you're a student figuring out your future, or a working professional thinking about your next move, this guide breaks it all down in plain English. Think of it as your insider’s map to everything the CFA charter can offer.

Decoding the CFA Charter

The Chartered Financial Analyst (CFA) designation is globally recognized as the gold standard in investment management. Earning the charter requires passing three rigorous exams, demonstrating four years of relevant work experience, and adhering to a strict code of ethics.

Think of these exams as climbing Mount Everest – challenging, yes, but the view from the top is incredible. They cover everything from financial analysis and portfolio management to ethical decision-making. It’s a comprehensive deep dive into the world of finance.

Holding the CFA charter signals expertise, dedication, and a commitment to the highest ethical standards. This makes charterholders highly sought after by employers worldwide.

A World of Career Opportunities

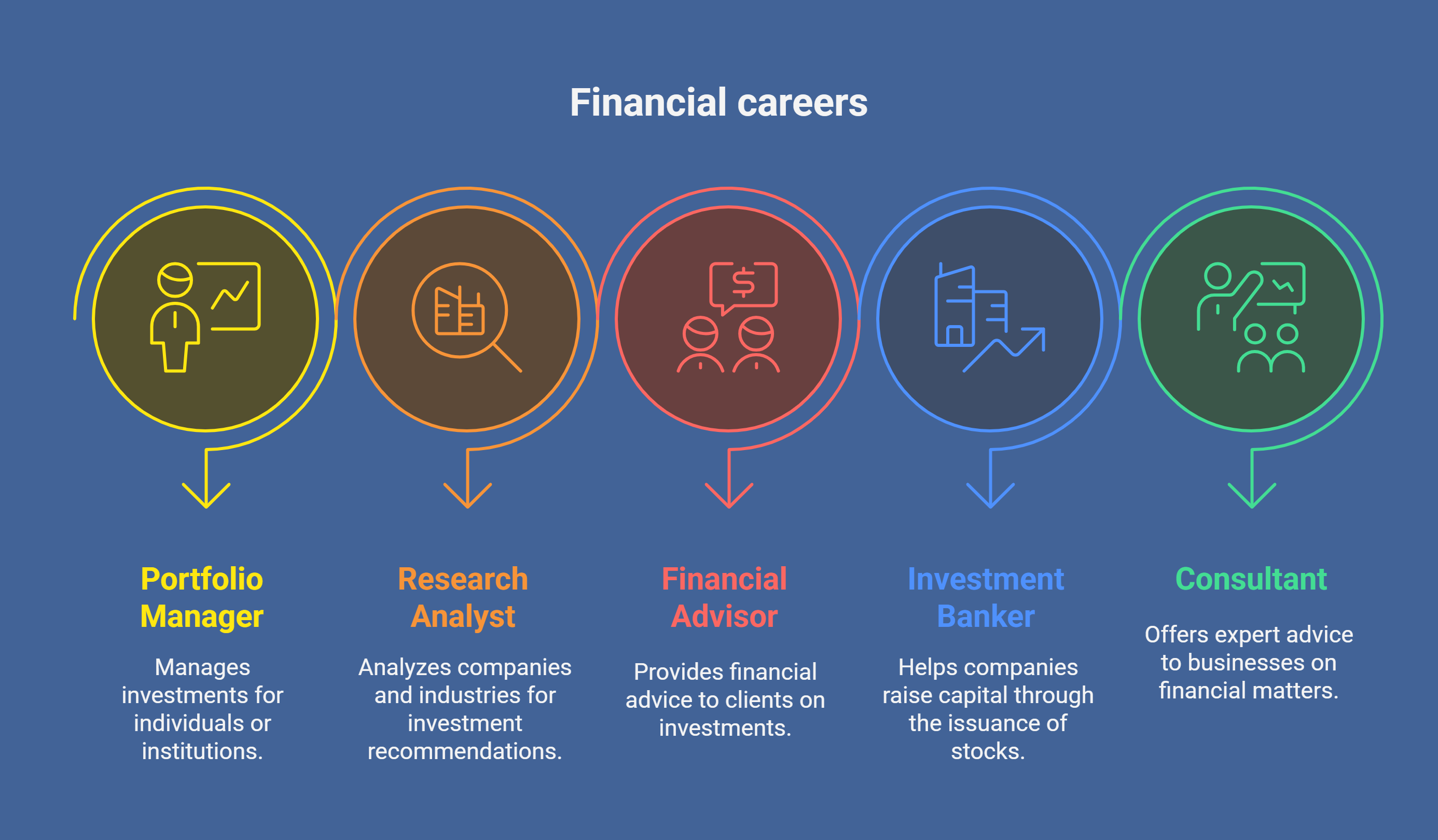

So, what can you actually *do* with a CFA charter? The answer: a lot! The charter opens doors to a wide range of career paths, offering flexibility and growth potential.

Many CFA charterholders pursue roles in portfolio management, managing investments for individuals, institutions, and funds. Others find themselves in research analysis, providing investment recommendations and insights.

And it doesn't stop there. Charterholders also excel in investment banking, consulting, and even private equity. The skills and knowledge gained through the CFA program are transferable across various financial disciplines.

Some popular roles include:

- Portfolio Manager

- Research Analyst

- Financial Advisor

- Investment Banker

- Consultant

Salary Expectations: Reaping the Rewards

Now for the part everyone's curious about: the money. CFA charterholders command competitive salaries, reflecting the value they bring to the table. While specific figures vary based on experience, location, and role, the earning potential is significant.

Entry-level positions for CFA charterholders often start in the six-figure range. As experience grows, so does the paycheck. Senior portfolio managers and other high-level roles can earn well into the hundreds of thousands, sometimes even millions, depending on performance and firm profitability.

Recent surveys indicate a healthy job market for CFA charterholders, with demand consistently outpacing supply. This translates to strong negotiating power and the opportunity to command top-tier compensation.

Conclusion

Earning the CFA charter is a significant investment of time and effort, but the payoff can be substantial. It's a pathway to a fulfilling career in finance, offering diverse opportunities and competitive salaries.

If you're passionate about finance and driven to succeed, the CFA charter might be the key to unlocking your full potential. It’s a challenging journey, but the rewards are well worth the climb.