Remember the SPAC boom? Wall Street was obsessed with this flashy financial tool that offered a quicker, arguably more convenient path to going public. Though the excitement has since died down—leaving some investors disappointed and others questioning their future—SPACs (Special Purpose Acquisition Companies) may still have life left in them.

At its core, a SPAC is an empty corporate shell set up with one goal: to merge with a private company and help it bypass the traditional IPO route. Think of it like a ready-made, publicly listed vehicle just waiting to pick up a private company and drive it straight onto the stock market.

SPACs in the Current Landscape

The initial euphoria surrounding SPACs led to a surge in activity, followed by increased regulatory scrutiny and a market correction. Many deals underperformed, leaving a slightly bitter taste in investors' mouths. This isn’t to say the SPAC model is inherently flawed, but the initial boom masked the underlying risks.

The tighter regulations introduced have, in a way, been a blessing in disguise. They’ve brought a much-needed dose of realism to the market, weeding out some of the more speculative ventures. The SPAC landscape of 2025 is more mature, characterized by greater due diligence, more realistic valuations, and a focus on long-term value creation.

Why SPACs Still Matter

So, why are SPACs still relevant? Several reasons.

- Speed and Efficiency: Even with increased regulation, the SPAC route to market is generally faster than a traditional IPO, which can be a lengthy and complex undertaking.

- Price Certainty: The merger process allows for more negotiation and price certainty compared to the sometimes unpredictable pricing in a traditional IPO.

- Access to Capital: For certain companies, particularly in emerging sectors, a SPAC can provide access to capital that might not be readily available through other channels.

Consider the case of a promising biotech firm developing a groundbreaking new therapy. The traditional IPO route can be particularly challenging for such companies, requiring extensive historical financial data which early-stage ventures often lack. A SPAC, however, can offer a lifeline, providing the capital needed to bring life-saving innovations to market.

The Future of SPACs

The SPAC market isn't dead; it’s evolving. The froth has subsided, replaced by a more pragmatic and discerning approach. Investors are now more cautious, performing deeper due diligence and focusing on companies with strong fundamentals.

I’ve spoken with several investment bankers who believe that SPACs will continue to play a significant role in the capital markets, albeit a more refined one. They see a future where SPACs are used strategically for specific types of companies and industries, rather than as a blanket solution for going public.

Conclusion

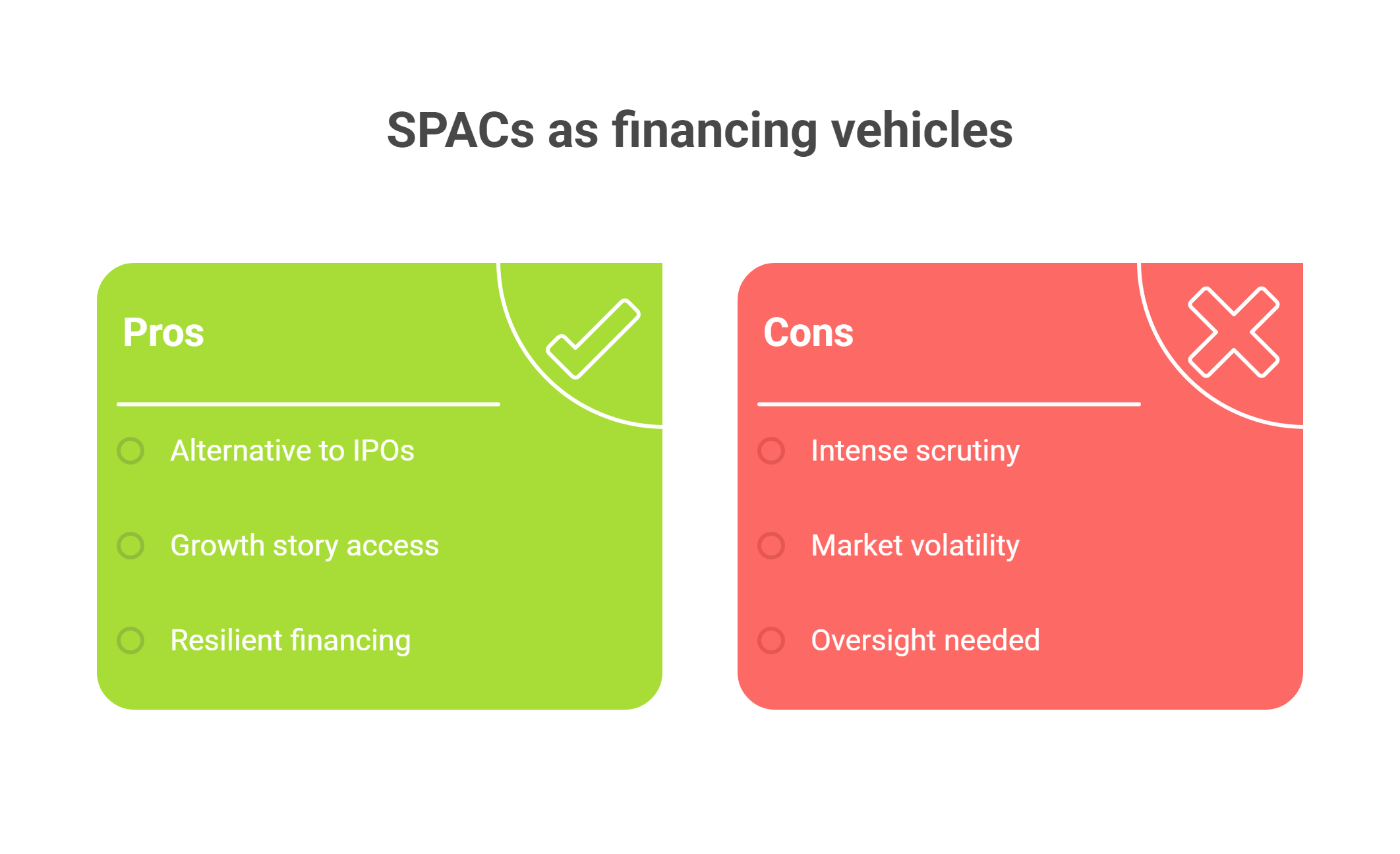

SPACs, after weathering a period of intense scrutiny and market volatility, have emerged as a more mature and resilient financing vehicle. They offer a viable alternative to traditional IPOs, especially for companies with compelling growth stories but limited access to traditional funding routes. As we move further into 2025 and beyond, SPACs, used judiciously and with appropriate oversight, will likely remain a relevant force in the ever-evolving world of finance.