The world of investment banking never hits pause. It’s constantly moving, adapting, and reshaping—and 2025 is no exception. Gone are the days of relying solely on static spreadsheets and outdated financial models.

Today’s finance world is alive with change—disruptive technologies, shifting investor expectations, and a regulatory landscape that seems to evolve overnight. The future isn’t waiting. It’s already here, and it’s transforming how deals are made and money moves.

The Fintech Frenzy: No Longer a Disruption, but the Norm

Fintech isn't some edgy newcomer anymore. It's woven into the fabric of investment banking. We're seeing a profound shift. Algorithmic trading has become more sophisticated, blurring the lines between human intuition and machine precision. Blockchain technology, once a buzzword, is now streamlining back-office operations, making transactions faster and more secure. Imagine a world where settlements happen in seconds, not days—that world is rapidly approaching.

The Rise of Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is shaking things up. This burgeoning ecosystem, built on blockchain technology, offers a compelling alternative to traditional financial intermediaries. Think peer-to-peer lending and borrowing, decentralized exchanges, and the tokenization of assets. Investment banks are scrambling to understand and integrate DeFi into their operations, recognizing both the immense potential and the inherent risks.

ESG Investing: More Than a Buzzword, a Mandate

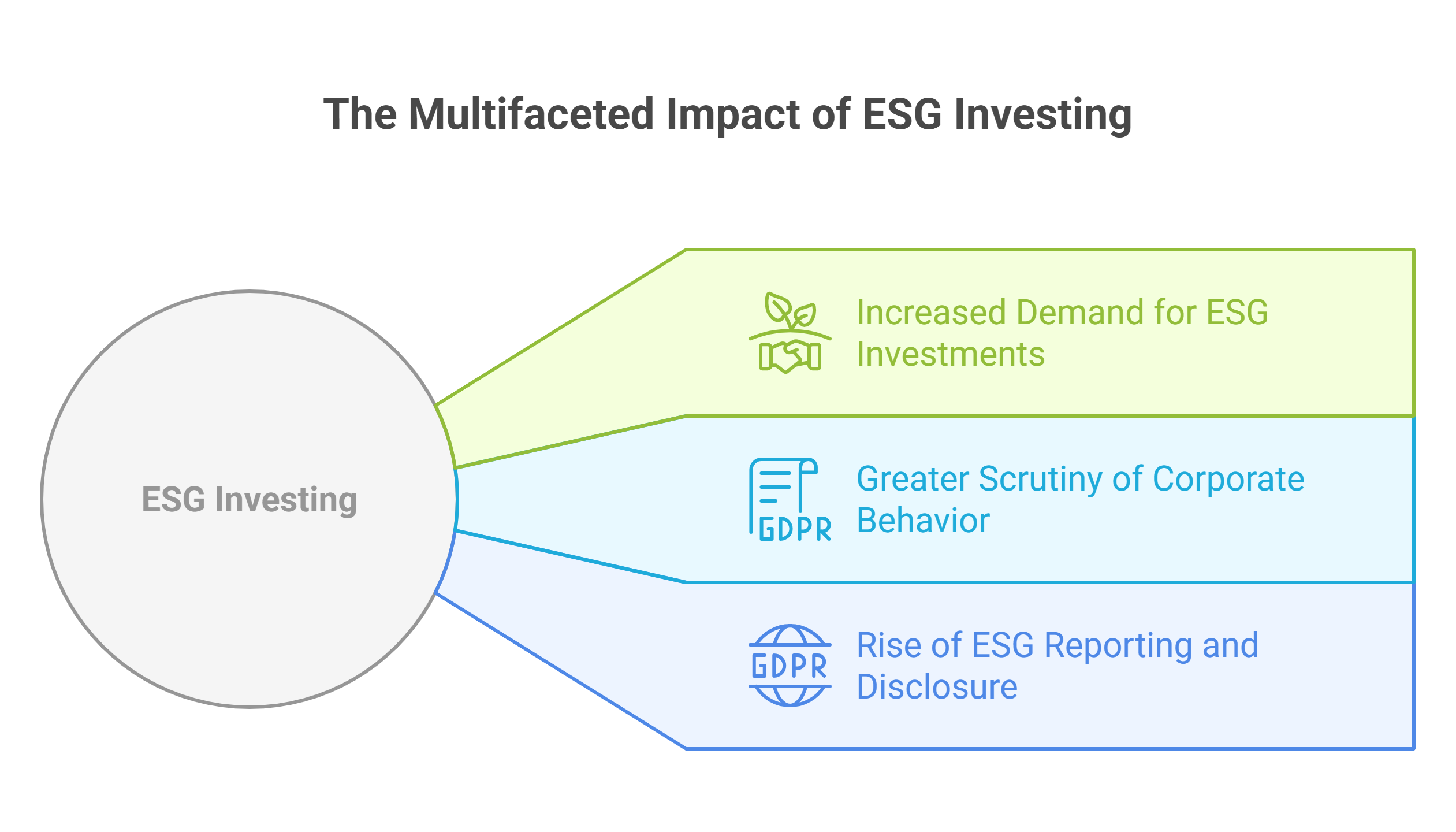

Environmental, Social, and Governance (ESG) investing has moved from the periphery to the mainstream. Investors are no longer just chasing profits; they're demanding accountability. They want to know where their money is going and what impact it's having on the world. This shift has forced investment banks to rethink their strategies, incorporating ESG factors into their dealmaking and advisory services.

- Increased demand for ESG-focused investments: Expect to see a surge in green bonds, sustainable funds, and other investment vehicles that align with ESG principles.

- Greater scrutiny of corporate behavior: Companies with poor ESG track records will face increasing pressure from investors and regulators.

- The rise of ESG reporting and disclosure: Transparency is key. Companies will need to provide detailed and verifiable data on their ESG performance.

The Regulatory Rollercoaster: Navigating an Uncertain Terrain

The regulatory landscape is constantly evolving, creating both challenges and opportunities for investment banks. From data privacy regulations like GDPR to the ever-shifting sands of financial regulations, navigating this complex terrain requires agility and foresight. Banks that can adapt quickly and effectively will have a distinct advantage.

The Talent War: Attracting and Retaining the Best and Brightest

The competition for top talent in investment banking is fierce. The industry needs individuals with a unique blend of skills—financial acumen, technological proficiency, and a deep understanding of the evolving regulatory environment. Banks are investing heavily in training and development programs to upskill their workforce and attract the next generation of leaders.

Conclusion: Embracing the Future of Finance

The investment banking landscape of 2025 promises to be both exciting and challenging. The confluence of technological advancements, evolving investor preferences, and regulatory changes will create both winners and losers. Banks that can embrace innovation, adapt to change, and prioritize talent will be well-positioned to thrive in this dynamic environment. The future of finance is not just about numbers and spreadsheets; it’s about understanding the tectonic shifts reshaping the industry and having the courage to navigate them effectively.