OYO: Investment Banking Case Study – A Global Hospitality Venture

After a tiring workweek, you and your friends want to relax in Goa. Looking for a quick and affordable stay, you turn to OYO’s app. In just a few taps, you find a budget-friendly hotel that meets your needs. While this seamless booking experience is convenient for travelers like you, behind the scenes, OYO has employed strategic investment banking practices to scale from a local startup to a global hospitality giant.

1: OYO’s Business Model and Financial Structure

OYO Rooms, founded by Ritesh Agarwal in 2013, aimed to simplify hotel bookings and deliver an affordable and consistent experience. The company evolved from being an online platform for hotel bookings to a comprehensive hospitality network, collaborating with small and mid-sized hotel owners globally.

Revenue Generation:

OYO generates its income primarily through:

- Commission Revenue: A percentage of each room booked through the OYO platform.

- Subscription Revenue: Charging hotel owners a fixed fee for standardizing their operations under the OYO brand.

Growth Metrics:

OYO expanded rapidly after receiving funding from major investors like SoftBank, Lightspeed Venture Partners, and Sequoia Capital. By 2024, OYO projected its revenue to surpass $2 billion, operating in over 80 countries with more than 230,000 properties worldwide.

2: Investment Banking Strategies Supporting OYO’s Expansion

Initial Capital Needs:

To expand internationally and improve its technology, OYO needed substantial capital. Investment banking played a crucial role in providing funding options and structuring deals for the company’s growth.

Funding Options for OYO:

- Private Equity & Venture Capital:

Early-stage investors, including SoftBank’s Vision Fund, injected billions into OYO. This equity funding enabled OYO to expand rapidly, acquire smaller chains, and enhance its technology platform.

SoftBank’s Contribution: SoftBank’s investment of over $1 billion in 2019 was pivotal

for OYO's global scaling efforts.

- Debt Financing:

OYO also sought debt to fund capital-intensive projects without diluting its ownership. By issuing bonds or taking out loans, the company could raise immediate funds while managing its equity base.

Debt Issuance Strategy: OYO raised funds through debt issuance, issuing corporate bonds with fixed coupon rates. This allowed the company to access low-cost capital, although it also introduced interest-bearing obligations.

3: Evaluating Key Investment Banking Considerations in OYO’s Strategy

A. Valuation and Market Conditions:

OYO’s valuation fluctuated as it scaled globally. To attract investors, the company had to present a compelling financial case, considering market demand and future growth potential.

- Revenue and Profitability Trends: OYO’s revenue growth was notable, but achieving profitability while maintaining aggressive expansion was a major challenge.

- Global Market Demand: The rise of digital travel solutions created a favorable environment for OYO, as more budget-conscious travelers sought affordable and consistent accommodations.

B. Investment Banking’s Role in Mergers & Acquisitions:

OYO used acquisitions as a way to enter new markets and consolidate its global presence. Investment banks facilitated these transactions by identifying suitable acquisition targets and helping negotiate favorable terms.

- European and Southeast Asian Acquisitions: OYO’s acquisition strategy included buying regional chains to quickly gain market share in international locations.

4: Financial Analysis of OYO’s Funding Strategies

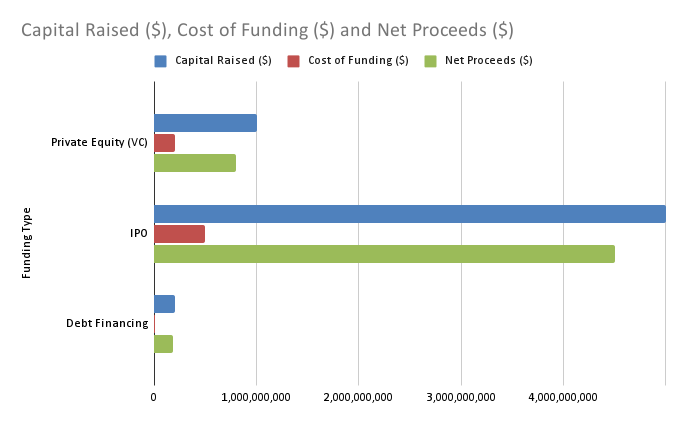

To understand OYO’s capital-raising approaches, let’s evaluate three funding strategies:

1. Private Equity (Venture Capital):

- Total Capital Raised: $1 billion

- Equity Dilution: 20% of OYO’s shares sold

- Investor Expectations: These investors sought high returns as the company scaled. However, maintaining profitability was essential for these investors to see returns.

2. IPO (Public Market Financing):

- Proposed IPO Value: $5 billion

- IPO Costs: Estimated at $500 million (including underwriting fees, legal, and marketing expenses)

- Net Proceeds: $4.5 billion

- Public Market Challenges: An IPO would have provided access to capital but also required OYO to meet public investors' expectations of transparency and steady growth.

3. Debt Financing:

- Total Debt Raised: $200 million (Corporate Bonds)

- Coupon Rate: 6%

- Annual Interest Payments: $12 million

- Debt Repayment: Total repayment of $240 million over 5 years

- Impact on Financials: While debt financing helped OYO secure capital, it introduced interest obligations, which could pressure cash flow if OYO's expansion did not meet targets.

5: Risk Evaluation in OYO’s Financial Strategy

1. Profitability and Debt Exposure:

Despite significant funding, OYO faced challenges in achieving consistent profitability. As its reliance on debt grew, so did its financial risk.

- Risk Mitigation: To balance these risks, OYO diversified its financing, blending equity and debt to maintain growth while avoiding excessive interest payments.

2. Equity Dilution Risks:

Equity funding, while essential, led to the dilution of founder Ritesh Agarwal’s stake in the company. This could impact decision-making power in the future.

3. Competitive Market Dynamics:

In more saturated markets, OYO struggled to maintain its initial growth momentum. The company faced increased competition, impacting its profitability.

6: Conclusion – Investment Banking Insights

OYO’s journey from a small startup to an international hospitality player provides key lessons in utilizing investment banking tools to accelerate growth. By strategically using private equity, debt financing, and considering an IPO, OYO was able to scale rapidly.

However, maintaining profitability while expanding internationally requires careful financial management. OYO’s case highlights the importance of structuring financial deals to minimize risks while maximizing growth potential, especially for companies navigating a rapidly changing global market.

As you enjoy the Goa sunset, you realize OYO’s rise from a small startup to a global brand mirrors your own seamless travel experience. From smart investments to bold moves, OYO has made traveling easier, one stay at a time.

Were you able to solve it?

Think you can make it as an Investment Banker? No??

No worries. Click the link below to join thousands of other aspiring individuals, students to working professionals, to learn from investment bankers who have been in the industry for almost 10 years! Learn industry-relevant skills and create flawless projects to become an Investment Banker on Wall Street!!

Join our latest cohort NOW!!

[Disclaimer: This case study is entirely hypothetical and unrelated to real-world situations. It's designed for educational purposes to illustrate theoretical concepts and potential scenarios within a given context. Any similarities to actual events or individuals are purely coincidental.]